gold hit record high

6-Mar-2024. The barbarous relic (or the pet rock) hit record highs. This is not the first time in recent years that gold has tried to permanently break above the $2,100 level. Will it work this time? The Gold certainly has a lot of catching up to do. This time the situation is more favorable because (1) gold has significantly lagged behind the AI and Bitcoin booms, and (2) we are getting closer to the first rate cut by the FED, which has historically led to gold's bull market. These are just the two most important points, yet the gold bulls can easily cite a long list of arguments why we are going to have a real bull market here. Figure 1 shows the gold price since the last rate hike by the Fed (last 3 cycles). Additionally, on the chart I marked the moment of the first rate cut and the period of recession (bold line) for each of the three historical cycles. Figure 2 shows the bull markets since 1969, and Figure 3 shows the gold price since 2008 in detail. Interestingly, in real terms the price of gold has not yet broken the peak from 1980 (Figure 4). But the "first bull market" in gold prices took place in 1933-1934 (+69%), but only the US government participated (Figure 5).

gold & real rates

14-Mar-2024. Gold, could the best part of the cycle be ahead of us? Gold is well known for its negative correlation with real interest rates. But as is the case with gold, even this correlation does not work perfectly. Figure 1 shows the price of gold against 10-year real interest rates. In the lower panels I have included the nominal federal funds rate and the spreads between 20-, 10- and 5-year real rates. The three periods when the relation stopped working are 2004-2007, 2016-2018, and 2022-2024. That is, when the Fed starts increasing interest rates, which means that real interest rates also start to rise. Figure 2 shows the period 2002-2008. Figure 3 shows the period 2015-2020. Figure 4 shows the period 2021-2025. It can be summarized that rising real interest rates at the beginning of the Fed's rate hiking cycle do not seem to be a problem. Only at the end of the hiking cycle and then when real and nominal rates are going down again - these are the best times for gold. Such timing also rhymes well with the inverted real yield curve, which, when inverted, begins to indicate the approaching end of rate hikes and another cycle of rate cuts. The best summary may be just Figure 5 - where I marked the best periods for gold from 2002 to today...

gold vs S&P500

4-Apr-2024. Gold stellar performance – not first time at this stage of the cycle. Since the last rate hike by the FOMC in July 2023, gold has already increased by 17.0%, and the S&P500 only 14.1%. Figure 1. If we look at the performance of gold after the last rate hike by the Fed, the current behavior of gold is similar to the cycles of 2018-2020 and 2006-2008 - see Figure 2. And what is the Gold 3-year rate of return, counting from the last hike ? – see Figure 3: +27.8% (2000-2003), +62.0% (2006-2009), +43.8% (2018-2021). Figure 4 shows the 3-year rate of return for gold and the S&P500 (counting from the last FOMC rate hike). Based on the last 3 cycles, whether gold outperforms the S&P500 depends mainly on the soft/hard-landing scenario (i.e. what will really happen after the FED starts the rate cut cycle).

too fast & furious to ignore

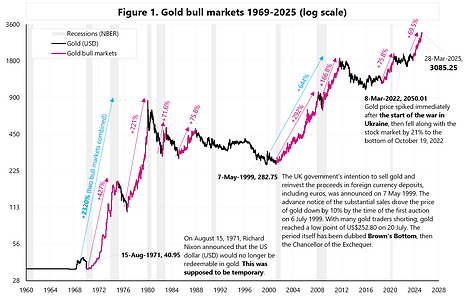

12-Apr-2024. "Too fast & furious to ignore" or "Fast & Furious 4" I couldn't resist and today's post has two titles 😊 Of course, this is all about gold, which is not only at another ATH (all-time-high), but has increased by over 15% over the last 2 months. Historically, we have had several strong bull markets when gold price increases were fast and furious. Figure 1 shows historical bull markets, today's bull market in gold is already +31.7% counting from the low on October 5, 2023. Figure 2 shows all ATHs since 1960. If we close on in the green today, it will be 20th ATH counting from December 1, 2023... Figure 3 shows all days when the 2-month rate of return exceeded 15%. Currently, this also takes place starting from April 9, 2024. Figure 4 shows the days when we had ATH and >15% 2-month return at the same time. Figure 5 is an allusion to the title, could we be now expecting Fast & Furious 4? All-in-all, today's gold price run is a perfect convergence of fundamental, monetary, technical and other factors... To be fair, in August 2020 we had a “fast & furious” false signal and the gold price dropped by 17.9% till Sep-2022 - see Figure 6.

mag7 & gold

13-Apr-2024. Will Mag7 soon start chasing gold? Last Thursday both the Mag7 and gold reached new all-time highs. In the case of gold, this is nothing new in recent weeks, but in the case of the Mag7 there was an outperformance against the S&P500 last week - see Figure 1. Could the Mag7 follow in gold's footsteps? To some extent, the same factors that allow for strong gold performance can also help Mag7 - of course, more in the context of the stock market. Mag7 are relatively safer companies for difficult times… What do the Mag7 and gold have in common? For example, they don't like rising interest rates, especially real ones... but recently they stopped paying attention to them. See Figure 2 and 3 for Gold and Figure 4 for the Mag7.

cryptos & gold

15-Apr-2024. Did cryptos help gold start rising? Certainly yes, to some extent. Cryptocurrencies were not present in previous cycles, and their current popularity may have additionally attracted attention, among others: on faith in central banks and fiat currencies. High rates of return also attract attention... Bitcoin has already increased by 311% since the bottom in November 2022. This year alone it is already up by 58%. Moreover, it started growing about one month before gold - see Figure 1. Of course, gold increased only by 13% - see Figure 2, where we have a comparison on one axis (gold vs top 5 cryptos). However, the total dollar impact is distributed differently - when we consider the markets cap of gold and cryptos - Figure 3. Figure 4 shows how much the market capitalization of gold and crypto has changed in 2024. Even though gold increased by only 13%, this means an increase in market capitalization by as much as $1.85 trillion - almost twice as much as in the case of cryptos. Bonus chart - what the change in the market cap of "scary assets" looks like against the change in the total market value of the US federal debt is shown in Figure 5.

Long Gold Short Mar-a-Lago

31-Mar-2025. Long Gold, short Mar-A-Lago Accord! Gold can be an ideal hedge for increased/high geopolitical risk.. Military conflicts, war in Ukraine, sanctions and tariffs, trade wars, lack of cooperation between Western countries, deglobalization, etc. In addition, historical bull markets in gold have given impressive returns! See Figure 1. In the 10 years from 2001 to 2011, for example, the price of gold increased by 644%! Recently, there has been a lot of talk on Wall Street about a new international agreement (Mar-A-Lago Accord) that may aim, among other things, to lower the value of the US dollar. The name of this agreement is a direct allusion to a similar agreement from 1985 concluded in New York at the Plaza Hotel - hence the colloquial name of that agreement, the Plaza Accord. The success of the 1985 Plaza Accord in the form of the dollar depreciation and achieving relative stability in currency markets was based on cooperation between the major Western countries. Then, until 2001, investors did not need gold as the hedge… so the gold underperformed. The chances for such cooperation today are very limited… which may additionally support gold as today investors feel the need for some protection/hedge – see Figure 2.