Treasury Markets

2Y UST > 4.90%!

29-Jun-2023. The 2-year UST yield rose to over 4.90% today following a decline in Initial Claims and an upward revision of GDP for Q1 2023. Since the hawkish employment report for May (published on June 2), yields are already up 55 bps. Rate hike on July 26: 89% probability. The probability of the next hike on November 1 is now 44%. The next employment report for June may also be hawkish... Powell is not done yet …

10Y UST > 5%!

9-Jul-2023. For the last two days yields of 2Y UST bonds were above 5% intraday. For two months they increased by around 125 basis points (and this is just the "equivalent" of 5 rate hikes of 25 bps). Not counting a few days in March this year – the last time 2Y yield was above 5% was in June 2007: 4 months before the S&P500 peak and only 3 months before the first rate cut by the FED (see chart). Today, the Fed Funds Futures market is pricing in the first rate cut as late as May 1, 2024 (and another rate hike is ahead of us on July 26 this year). Are we near the top on US 2Y bond yield similar to 2007? Quite possibly, looking at the employment report for June 2023. The labor market in the US is slowing down very slowly, but still. And now it is the labor market that is the key to completing the current cycle. It is enough that it does not accelerate, but only slowly slows down (then we can count on a long pause). The market valuation of the first interest rate cut should be viewed with a pinch of salt. As a reminder, the market in March this year (at the epicenter of the banking crisis) priced in the first rate cut already on June 14, 2023 to 450-475 bps level. According to today's market valuation, we can count on rates of 450-475 bps only on September 25, 2024 😊.

Yields vs Supply

1-Aug-2023. We beat inflation (CPI in the US is only 2.97% YoY) and bond yields not only are not falling, but are even increasing? Today yields of 10Y UST bonds broke 4% again and closed at 4.04% (+7 bps). One of the direct reasons for the increase in yield is the higher supply announced by Treasury for Q3 (excerpt from the announcement: During the July – September 2023 quarter, Treasury expects to borrow $1.007 trillion in privately-held net marketable debt (…) The borrowing estimate is $274 billion higher than announced in May 2023.) But in the background we also have a stronger economy, rate hikes by the FED, recently rising oil prices, but also the expected rebound in inflation in the coming months after the end of positive base effects.

Yields vs Inflation Rate

6-Aug-2023. US inflation rate vs US Treasury bond yields. June 2022: US YoY inflation: 9.06% 10-year bond yield: 3.13% (average yield in June 2022) 2-year bond yield: 2.99% (average yield in June 2022) June 2023: US YoY inflation: 2.97% 10-year yield: 4.18% (3 Aug 2023) 2-year yield: 4.88% (3 Aug 2023) Go figure 😊

Bonds vs Stocks

8-Aug-2023. Bonds (US Treasury) vs Stocks (S&P500). From January 2022 to May 2023, the decline in bond prices also meant a decline in stock prices (in other words, higher bond yields - lower stock prices). But since May, the market regime has changed and stocks are no longer bothered by higher yields.. if we were to have a correction on stocks right now - then bond yields should also fall on a mean-reversion basis.. (prices up) - see chart. The situation is the same for real rates vs S&P500/Nasdaq100 (see next two charts) - the market regime has also changed since May ... equities, and in particular technology companies (Nasdaq100) are not bothered by higher real interest rates ... However, the market regime has not changed for equities/S&P500 vs EURUSD... here risk-on means stronger Euro and risk-off means stronger dollar (EURUSD pair) - see chart.

Next BIG SHORT !

13-Aug-2023. What could be the next big short? For example, going long UST (U.S. Treasury) duration "could feel like a big short" in the stock market (during a recession). But even if today there is no recession, this period of the cycle still provides (ex ante - what is important) the most attractive relation of expected return from UST vs S&P500: Example of 2018-2020: S&P500 -18%; iShares 20+ Year ETF +62% Example of 2007-2009: S&P500 -53%; iShares 20+ Year ETF +57% Example of 2000-2002: S&P500 -46%; 30Y UST approx. +54% (10Y UST approx. +44%)

13-Aug-2023. “Next big short” – part 2. It may be too early for a new bull market in UST to begin, but historically, UST 10Y yields peaked around the last rate hike by the Fed. The 10Y yield peak occurred from 4 months before the last rate hike by the FED to 1 month after such an increase (see chart). But there is one more condition... it concerns the “deflationary cycles” (i.e. 1984, 1989, 1995, 2000, 2006, 2018). In other words, in such cycles, inflation was never a problem, so the market was "earlier" certain of the end of rate hikes and the beginning of disinflation and a possible slowdown in the economy (which was then associated with another cycle of interest rate cuts by the Fed and a real bull market in the UST). However, in the inflationary cycles (1969, 1974, 1981) the last hike did not stop the increase of 10Y yield. In other words, the market continued to play persistent/higher inflation for some time (see second chart). In the 3 inflation cycles of the 1970s, the Fed rate was finally much higher than the 10Y yield itself (just like today). What cycle do we have today, inflationary or disinflationary? The market can't quite make up its mind. July's Fed hike may have been the last in the cycle, but it doesn't seem to stop 10Y yields from rising. In other words, the current cycle is somewhat in between inflationary and deflationary cycles. Either way, another cycle of FED rate cuts is ahead of us... and similarly another UST bull market - either sooner (as in deflationary cycles) or a bit later (as in inflationary ones).

14-Aug-2023. “Next big short” – part 3. What happens to the 10Y UST yield after the last Fed hike in the cycle? The first chart shows all 7 historical cycles (the 10Y yields from the day before the announcement of the last FED hike were moved to July 25, 2023). The chart is a bit unclear, so the next two charts show deflationary cycles and inflationary ones separately (but the 10Y yield level for every cycle was additionally scaled to the yield level of July 25, 2023). In inflationary cycles yields also fall, but a little bit later than in deflationary ones - as another cycle of interest rate cuts by the FED is simply inevitable... The last chart shows the average yield paths for the inflationary and deflationary cycles. Since the current cycle is neither clear-cut inflationary nor deflationary, one could expect it (only based on some historical analogy) to run more or less between the two average paths… (dashed line on the chart)..

Long Bond Drawdowns

25-Sep-2023. At today's close, iShares 20+ Year Treasury Bond ETF (total return) is down 46% from its previous cycle peak on March 9, 2020 (see chart). The situation is similar in Europe for iShares € Govt Bond 15-30yr UCITS ETF Total Return (see next chart). Maybe not today, but we are getting closer to the peak in yields in the current cycle, and then we will see a move in the other direction... As a reminder, what were the rates of return in the subsequent cycle of yields going down: 1) in the years 2000-2002: 10Y bonds +44% 30Y bonds +54% and for S&P500 -46% (see chart) 2) in 2007-2010: iShares 20+ Year Treasury Bond ETF Total Return +57% iShares Core S&P 500 ETF Total Return -53% (see chart) 3) in 2018-2020: iShares 20+ Year Treasury Bond ETF Total Return +62% iShares Core S&P 500 ETF Total Return -18% (see chart)

Long duration UST or S&P500?

26-Sep-2023. Long US Treasuries or S&P500? Total return from 2007 to Q1/Q2 2020 was about the same (after 13 years). Since 2020, stocks have clearly beaten bonds (Covid-19 & inflation)... but that's only slightly over 3 years... As of May 31, 2020, the annualized rate of return (total return) since December 31, 2006 was: For US Treasuries +8.06% For Euro Govt >15 +6.96% For S&P500 +8.06% (see chart) And as of September 25, 2023: For US Treasuries +3.04% For Euro Govt >15 +2.75% For S&P500 +9.02% (see chart) For rates of return to be equal, US Treasuries should increase by 157% or the S&P500 should fall by 61%. Of course, everything in between will do the math as well... :)

CPI vs US Treasury Yields

7-Oct-2023. CPI vs US Treasury Yields. Update. (1) First chart. UST yields left axis. Inflation YoY right axis. Highest inflation June 2022: 9.06%; 10Y yield (monthly average): 3.13%; 2Y: 3.0% Lowest inflation July 2023: 2.97%; 10Y: 3.75%; 2Y: 4.66% October 6, 2023: - inflation for September 2023: 3.69% (Cleveland FED's Inflation Nowcast), - inflation for October 2023: 3.48% (Cleveland FED's Inflation Nowcast), - 10Y: 4.80%; 2Y: 5.08%. And also for complete sort of overview, e.g. August 2021: inflation 5.25%; 10Y: 1.28%; 2Y: 0.21% Generally speaking, one could say that the market was not concerned about inflation .. until .. it dropped to the range of 3.0-3.7%. (2) Second chart. The same data series but on one axis. One could say that inflation has made a round trip but the yields are on the one-way road.. i.e. only rising... Looks like inflation isn’t the main concern of the market ... go figure.

Long UST Key Facts

8-Oct-2023. Long duration Treasuries. Key facts. US: iShares U.S. Treasury Bond ETF (total return) Euro: iShares € Govt Bond 15-30yr UCITS ETF (total return) Rate of return in 2023, YTD, see chart: US: -12.52% Euro: -6.03% Rate of return since 31-Dec-2006, see chart: US: +57.33% (so we have erased almost 10 years…) Euro: +53.11% (have erased almost 10 years) Today's drawdown, see chart: US: -48.28% Euro: -43.76% Bonus calculation, what’s today’s upside to previous all-time-high, see chart: US: +93.34% Euro: +76.74%

UST: 2023 vs 2006-2007

11-Oct-2023. 10y US Treasuries yield is already down by some 25 bps from recent peak! If we are: (i) in the H4L – higher for longer setup, (ii) the last FED’s hike is behind us, and (iii) economy is strong enough to withstand federal fund rate above 5%.. then we should get a long FED’s pause… The current situation resembles the years 2006-2007, when the pause lasted as much as 15 months, and the spread between the federal fund rate (mid-band) and the 10Y was not greater than 82 bps throughout the pause. Today, this would mean the 10Y yield should generally not fall below 4.55% (fed rate mid-band is 5.375%). Currently 10Y is at 4.56%. In 2007, the above spread widened to 92 bps only about 10 days before the Fed's first rate cut on September 18, 2007.

Long Treasuries

20-Nov-2023. Long Treasury Bonds. Almost 10% up. Rates of return since the recent low in October 2023 (Chart 1): 1) US 20+ Year Treasury ETF Total Return: +9.10% 2) EU Govt Bonds 15-30y ETF Total Return: +7.58% But in the long run there are still significant losses. Counting from December 31, 2018 (in October/November 2018, we had the bottom in the previous cycle), Chart 2: 1) US 20+ Year Treasury ETF Total Return: -17.49% 2) EU Govt Bonds 15-30y ETF Total Return: -21.19% From December 31, 2006, Chart 3: 1) US 20+ Year Treasury ETF Total Return: +67.59% 2) EU Govt Bonds 15-30y ETF Total Return: +63.71%

20-Nov-2023. What’s the upside to the all-time-high and what’s the margin of safety in the case of downside? Long Treasury Bonds. Part 2. In the case of iShares 20+ Years Treasury Bonds ETF upside to the all-time-high is as much as 81.5% (Chart 1). And what's the downside? It depends mainly on future inflation, but in case of the downside we can also talk about the so-called margin of safety, which now is supported by the current high yield of the ETF’s portfolio (current average yield to maturity is 4.76%). Margin of safety is the maximum range of increase in bond yields in the ETF's portfolio so that we do not lose money in the next 12 months. With an effective duration of 16.46 years, approximately yields could increase by as much as 78 bps on average within a year and we would still not be at a loss. For example, in the case of 10-year US bond, the current yield is 4.46% (we would see a loss only after exceeding the level of 5.24% - the difference is our margin of safety). Chart 2 shows the size of the drawdowns. In 2023, the drawdown was record-breaking, as much as 49.5%. Chart 3 shows the total returns for the iShares 20+ Years Treasury Bonds ETF since the bottom of the cycle (for 2007-2008; 2018-2020; and 2023 cycles).

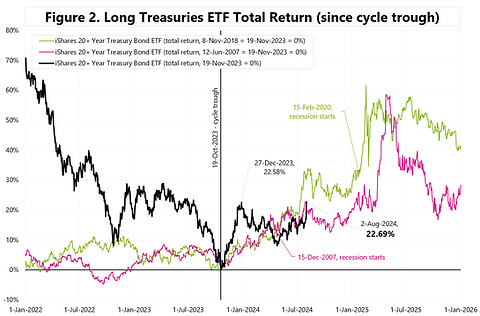

TLT is up 20%

2-Jan-2024. TLT is up 20%. iShares 20+ Year Treasury Bond ETF (TLT) is already over 20% from the current cycle low of October 19, 2023 (Figure 1), but virtually flat from the previous cycle low (8-Nov-2018, see Figure 2). The full cycle first meant an increase of 60% (from 8-Nov-2018 to 9-Mar-2020), then a decrease of 50% (to 19-Oct-2023), and now we are rebounding >20%...

QRA - January 2024

29-Jan-2024. QRA – Quarterly Refunding Announcement. The market is waiting for QRA, especially after the experience with the publication in Q3 and Q4 2023. Coincidence or not, both previous releases coincided with major market turning points. See Figure 1. Below is the QRA from October 30, 2023 (fragments): The U.S. Department of the Treasury today announced its current estimates of privately-held net marketable borrowing for the October – December 2023 and January – March 2024 quarters: During the October – December 2023 quarter, Treasury expects to borrow $776 billion in privately-held net marketable debt, assuming an end-of-December cash balance of $750 billion. The borrowing estimate is $76 billion lower than announced in July 2023, largely due to projections of higher receipts somewhat offset by higher outlays. During the January – March 2024 quarter, Treasury expects to borrow $816 billion in privately-held net marketable debt, assuming an end-of-March cash balance of $750 billion. And the financing structure that is key for the markets (short or long securities), announcement on November 1, 2023 (excerpts, see the table below !!): Treasury plans to continue with gradual nominal coupon and FRN auction size increases, but at a more moderate rate in longer-dated tenors. Treasury will continue to evaluate whether additional relative adjustments are appropriate when determining future changes in auction sizes. Treasury plans to increase the auction sizes of the 2- and 5-year by $3 billion per month, the 3-year by $2 billion per month, and the 7-year by $1 billion per month. As a result, the auction sizes of the 2-, 3-, 5-, and 7-year will increase by $9 billion, $6 billion, $9 billion, and $3 billion, respectively, by the end of January 2024. Treasury plans to increase both the new issue and the reopening auction size of the 10-year note by $2 billion and the 30-year bond by $1 billion. Treasury plans to maintain the 20-year bond new issue and reopening auction size. Treasury plans to increase the November and December reopening auction size of the 2-year FRN by $2 billion and the January new issue auction size by $2 billion. The table below presents, in billions of dollars, the actual auction sizes for the August to October 2023 quarter and the anticipated auction sizes for the November 2023 to January 2024 quarter: ----- Below is the QRA from July 31, 2023 (fragments): WASHINGTON -- The U.S. Department of the Treasury today announced its current estimates of privately-held net marketable borrowing for the July – September 2023 and October – December 2023 quarters. During the July – September 2023 quarter, Treasury expects to borrow $1.007 trillion in privately-held net marketable debt, assuming an end-of-September cash balance of $650 billion. The borrowing estimate is $274 billion higher than announced in May 2023, primarily due to the lower beginning-of-quarter cash balance ($148 billion) and higher end-of-quarter cash balance ($50 billion), as well as projections of lower receipts and higher outlays ($83 billion). During the October – December 2023 quarter, Treasury expects to borrow $852 billion in privately-held net marketable debt, assuming an end-of-December cash balance of $750 billion. And the financing structure that is key for the markets (short or long securities), announcement on August 2, 2023 (excerpts, see the table below !!): Treasury plans to increase the auction sizes of the 2- and 5-year by $3 billion per month, the 3-year by $2 billion per month, and the 7-year by $1 billion per month. As a result, the auction sizes of the 2-, 3-, 5-, and 7-year will increase by $9 billion, $6 billion, $9 billion, and $3 billion, respectively, by the end of October 2023. Treasury plans to increase both the new issue and the reopening auction size of the 10-year note by $3 billion, the 30-year bond by $2 billion, and the $20-year bond by $1 billion. Treasury plans to increase the August and September reopening auction size of the 2-year FRN by $2 billion and the October new issue auction size by $2 billion. The table below presents, in billions of dollars, the actual auction sizes for the May to July 2023 quarter and the anticipated auction sizes for the August to October 2023 quarter:

30-Jan-2024. Markets got a positive surprise with yesterday's QRA release. Immediately after the announcement, the S&P500 jumped about 10 points and continued to grow until the close. We had similar reactions on the dollar (weakening) and the 10Y yield dropped by about 4 bps by the end of the session, while the 2Y reaction was much weaker (in sum, no major changes until the end of the session). When it comes to Q1 2024, we will have a smaller supply of treasury securities due to higher expected net fiscal flow: “During the January – March 2024 quarter, Treasury expects to borrow $760 billion in privately-held net marketable debt, assuming an end-of-March cash balance of $750 billion. The borrowing estimate is $55 billion than lower announced in October 2023, largely due to projections of higher net fiscal flows and a higher beginning of quarter cash balance.” For Q2 2024: “During the April – June 2024 quarter, Treasury expects to borrow $202 billion in privately-held net marketable debt, assuming an end-of-June cash balance of $750 billion.” Table 1 provides a detailed summary. In Q4 2023, Treasury borrowed $776 billion, exactly as much as it expected to borrow in October: „In October 2023, Treasury estimated borrowing of $776 billion and assumed an end-of-December cash balance of $750 billion. There was no change in privately-held net market borrowing although the ending cash balance was $19 billion higher due primarily to other sources of financing including lower than projected discount on marketable borrowing.” The QRA (part 2) will be released at 8:30 a.m. on Wednesday, January 31, 2024. Yet, it should be kept in mind that the main determinants of future bond yields are the path of Fed rate cuts and future inflation (rather than the supply of treasuries securities and its structure).

UST update 1-Mar-2024

3-Mar-2024. An exciting end to the week on the markets. Part 2. Much more interesting things are happening on the rates/bonds side, with higher inflation readings losing out to weaker economic data and the mention of increased purchases of short-term T-bills by the Fed (financed by selling MBS holdings to zero). Could higher inflation not be so terrifying? See Figure 1. FED's Waller "made a round trip".. on February 23 was quite hawkish and 10Y yields then touched 4.35% - and on March 1 he mentioned increasing purchases of short-term T-bills - and yields ended the day at 4.18%. Waller on increasing T-bills purchases: “Thinking about longer-term issues related to the Fed’s portfolio, I want to mention two things. First, I would like to see the Fed’s agency MBS holdings go to zero. (…) Second, I would like to see a shift in Treasury holdings toward a larger share of shorter-dated Treasury securities. Prior to the Global Financial Crisis, we held approximately one-third of our portfolio in Treasury bills. Today, bills are less than 5 percent of our Treasury holdings and less than 3 percent of our total securities holdings. Moving toward more Treasury bills would shift the maturity structure more toward our policy rate—the overnight federal funds rate—and allow our income and expenses to rise and fall together as the FOMC increases and cuts the target range. This approach could also assist a future asset purchase program because we could let the short-term securities roll off the portfolio and not increase the balance sheet.” A decrease in ISM Manufacturing by 1.3 points to 47.8 - plus a drop in construction spending in January (by 0.2% MoM, 1st negative monthly print since Dec-2022) lowered the Atlanta GDP tracker growth forecast in Q1 2024 from 2.95% to 2.12% - see Figure 2. A very interesting net effect...we are currently at the 10Y UST yield only 2bps above the yield immediately before the publication of red hot January CPI inflation data (February 13).

Is oil leading yields?

3-Jun-2024. Is oil leading yields? After today's weaker ISM Manufacturing PMI (a drop from 49.2 to 48.7, with an increase to 49.6 expected), we have quite a strong reaction to oil prices (WIT falls 3.8% today.., btw.. good luck to OPEC+ with their exit strategy of production cuts). Bond yields are also falling significantly today (10Y UST is down 11 bps). The dollar weakened meaningfully (the dollar index is down 0.54%; and the EURUSD is up +0.46%). The S&P500 closes the day practically flat (but Nvidia is up 4.8%... definitely after good weekend news from Taiwan). But is the falling oil price somehow leading tumbling yields? – see Figure 1. This may not be a perfect correlation, but recently oil prices seem to be ahead of rates.. Figure 2 shows the same, but in a longer time frame.... Except for the second half of 2022 (rising yields, falling oil prices), the relationship is quite significant in the medium term. Figure 3 shows an even longer time horizon, starting from 2015. Falling oil price certainly needs to be watched and may contribute to falling bond yields.

Bonds just wanna have fun

3-Aug-2024. Bonds just wanna have fun! Not all asset classes are struggling today. Bonds and gold are a natural hedge against difficult times. Gold is currently only 1.3% below the all-time high of $2,468.8 (at closing prices), and during the last session was only 0.24% from its intraday ATH of $2,483.6. However, bonds (iShares 20+ Year Treasury Bond ETF: TLT) are at a local high and have increased by 7.7% since July 24 - see Figure 1. Figure 2 shows the rate of return on TLT since the bottom of the cycle. However to really have some fun, the bonds should go to its own ATH, which is some 60% up ! See Figure 3. 😊

Oil vs Yield

15-Oct-2024. Is oil leading yields? WTI crude oil is down sharply today (-4%), continuing its declines after generally disappointing data from China (in terms of stimulus size) and a de-escalation of the Middle East conflict (after a report that Netanyahu told the US that Israel will strike the Iranian military and not nuclear or oil targets). Is it time for bond yields to fall? See Figures 1 and 2. The charts don't show it (only closing prices), but yesterday's peak on 10Y yield (intraday) was a whopping 4.15%! At the moment, yield is down from yesterday's peak by almost 7 bps.

UST Term Premium

15-Jan-2025. Term Premium at its highest in 11 years! Why are bond yields still rising? 10Y UST has just broken through 4.80% and is threatening the stock market, but in practice, other assets as well. Recently, one of the common answers is the growing "term premium". Figure 1 shows the term premium for the 10-year US bond yield (according to the ACM model). But what exactly is a "term premium"? A few definitions: - New York FED: "the compensation that investors require for bearing the risk that interest rates may change over the life of the bond"; - San Francisco FED: "the excess yield that investors require to commit to holding a long-term bond instead of a series of shorter-term bonds"; - BIS: "the compensation, or risk premium, that risk-averse investors demand for holding long-term bonds". In other words, instead of buying a 1-year bond and then rolling over that purchase for 10 years... you can buy a 10-year bond straight away (for an extra premium or discount). But there are other definitions of "term premium" e.g. (H/T to zerohedge): - "mystical "plug" concept that supposedly explains bonds moves when nothing else does"; or - "a concept beloved by financial wonks and STIR traders as it allows them an easy loophole to "explain away" stuff they have no clue about: just blame the "term premium". Or one interesting interpretation is that it is a yield above that explainable by expected economic activity and future inflation... thus reflecting bond market sentiment. All-in-all the most important thing is the narrative/sentiment behind the sudden increase in the term premium. As of today it seems that it is mainly the uncertainty of the bond market regarding the actual policy of the new administration.. but this uncertainty has a chance for the first explanations in a few days.. we’ll see if more clarity also means lower term premium.. Figure 2 shows the ACM 10Y term premium since 2010.

Buy Humiliation ?

26-May-2025. “Buy Humiliation, sell Hubris” – this approach was presented by BoA’s investment strategist Michael Hartnett in his latest report “The Flow Show”. What is Humiliation? Just long-end US Treasuries! Humiliation #1: total return since 31-Dec-2006: iShares 20+ Year Treasury Bond ETF: +67,2% iShares Euro Govt Bond ETF: +71,7% iShares Core S&P500 ETF: +481,5% Humiliation #2: annualized total return since 31-Dec-2006: iShares 20+ Year Treasury Bond ETF: +2,83% iShares Euro Govt Bond ETF: +2,98% iShares Core S&P500 ETF: +10,04% Humiliation #3: 10-year rolling annualized total return: iShares 20+ Year Treasury Bond ETF: -0,93% iShares Euro Govt Bond ETF: -1,08% iShares Core S&P500 ETF: +12,51% Humiliation #4: 5-year rolling annualized total return: iShares 20+ Year Treasury Bond ETF: -10,14% iShares Euro Govt Bond ETF: -6,92% iShares Core S&P500 ETF: +16,16% However, as always there is a silver lining too: what’s the nominal return required to get to a new all-time-high: iShares 20+ Year Treasury Bond ETF: +81,93% iShares Euro Govt Bond ETF: +57,64% iShares Core S&P500 ETF: +5,51%