The Mag 10

Revenues & Gross Margins

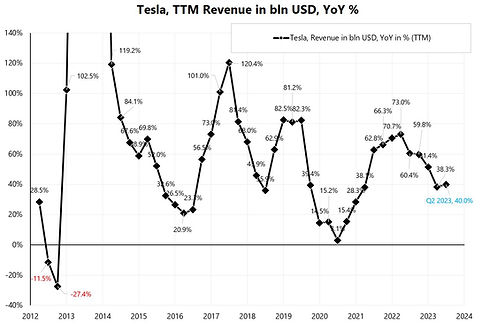

30-Jul-2023. GOOGL, MSFT, TESLA, AAPL, META: Revenue & gross margin Comparison of revenue volume (TTM - trailing twelve months) and TTM YoY revenue growth, as well as gross margin on sales (i.e. gross profit / revenue) - see charts... Tesla is the smallest company (volume of sales), but also the fastest growing with revenue growth of 40% - so it is a typical growth company. The remaining companies are rather difficult to classify as classic growth companies (they are too big and mature), where TTM revenues grow around 0% (Apple, Meta), and 4-7% (Microsoft, Alphabet). It can even be said that these are already cyclical companies, where the increase in revenues largely depends on the growth of the entire economy… What is interesting, however, is the profitability of business measured by the gross margin, which ranges from 18% (Tesla) to as much as 81% (Meta). Meta with such a profitable business can aggressively finance new product lines that generate approximately $4 billion in operating loss per quarter.

Revenue vs Nominal GDP

31-Jul-2023. GOOGL, MSFT, TESLA, AAPL, META: revenue growth vs nominal US GDP growth On the trailing 12 month basis (see chart 1), in Q2 2023 only Tesla's revenue is growing faster than nominal GDP. Below the increase in YoY revenues in Q2 for individual companies: Tesla: +40,0% Nominal US GDP: +7,5% Microsoft: +6,9% Alphabet: +4,1% Meta Platforms: +0,9% Apple: -1,17% (assuming 80,9 bln USD of revenues in Q2). Nevertheless, it should be remembered that in 2021 the revenues of these companies grew up like a weed after the pandemic stimuli, so it is also worth comparing the increase in cumulative revenues from Q4 2019 (see chart 2): Tesla: +238% Alphabet: +62% Microsoft: +52% Meta Platforms: +52% Nominal US GDP: +24% Apple: -12% (assuming 80,9 bln USD of revenues in Q2). Apple looks particularly uninteresting, although one should remember about strong seasonality here, and that the strongest quarter is Q4, not Q2, so we are not directly comparing apples to apples :), but even if we compare YoY growth for quarterly revenues (see chart 3), Q2 2023 will be the 7th quarter in a row for Apple with sales growth lower than the nominal growth of US GDP.

Mag7 after Q2 2023 Results

6-Aug-2023. How did the market assess the quarterly results of the largest US companies? The biggest positive surprise is Amazon +8.8% against the S&P500. The worst Tesla -10.9% against the S&P500. See the charts META, GOOGLE, AMZN above expectations, APPL, MSFT, TESLA below expectations.

Does Mag7 trade implodes?

29-Oct-2023. The Mag7 trade implodes? Over the weekend, you can read a little about changing sentiment and narrative regarding the Mag7, which boosted the entire market this year. And while the Mag7 dropped more than the S&P500 in the last two weeks (however in the last week it dropped even less than the S&P500), looking from the beginning of the current correction (31-Jul-2023), the Mag7 index still outperforms the S&P500 - see chart 1. How individual companies behave during this period... see chart 2. Microsoft and Amazon, after strong Q3 results, have fallen only slightly and so far uphold the entire Mag7 club. Of course, looking at the returns since the beginning of the year (Chart 3), a larger correction/mean-reversion for the Mag7 club could certainly be due. Links to Amazon Q3 results: https://lnkd.in/dwYvqqqn https://lnkd.in/dswAUziN Link to Microsoft Q3 results: https://lnkd.in/dN7w4555

Nifty Seven / Nifty Eight

1-Nov-2023. Nifty Seven. Nifty Eight. Nifty Fifty. -4.14% is how much the S&P500 Equal-weights fell in October (-3.84% from the beginning of the year). However, the largest companies are doing much better: 1) Nifty Seven (aka The Magnificent 7) in October -0.34% and +60.35% in 2023, YTD (market-cap weights) in October -2.86% and +79.06% in 2023, YTD (equal weights) 2) Nifty Eight (aka The Enormous 8 - Mag7 + Netflix) in October -0.14% and +60.22% in 2023, YTD (market-cap weights) in October -1.26% and +74.62% in 2023, YTD (equal weights) 3) Nifty Fifty (aka S&P500 Top 50) in October -1.41% and +21.25% in 2023, YTD (market-cap weights) After the fantastic results for Q3 2023, the best returns in October were Microsoft (+7.08%), Amazon (+4.70%), and Netflix (+9.03%). Tesla reported poor results (-19.73% in October). What is missing? Apple (tomorrow) and Nvidia results (21-Nov-2023). In Apple's case, disappointment may come from relatively lower sales in China. In the case of Nvidia, expectations are high regarding results, and for example AMD after reporting Q3 result (despite good results for Q3) scared a little bit the market with the too low revenue guidance for Q4 (approximately $6.1 billion, plus or minus $300 million which was below the Wall Street estimate of $6.4BN).

Mag7+, Q3 2023 Rundown

6-Nov-2023. The Mag7+ short wrap-up of Q3 results. Of the 7 companies, only Tesla failed to beat Wall Street's revenue growth expectations. All companies beat the EPS forecast (Amazon by as much as 62%). With revenues of $143B per quarter, Amazon can grow at a rate of +12.6%! The table shows details about revenues and EPS, as well as how the price of a given company behaved after the announcement of Q3 results. Tesla disappointed the most, while Amazon was the best performer (see also the chart). Based on Factset data (as of November 3), here are Q3 results for the entire S&P500 (for companies that have already reported): 1) the blended (combines actual results for companies that have reported and estimated results for companies that have yet to report) earnings growth for the third quarter is 3.7% 2) the blended revenue growth rate for the third quarter is 2.3% So, The Mag7+ are performing much better than the S&P500 with average earnings growth +62%, and average revenue growth +13,8%.

The Mag7 YTD Returns

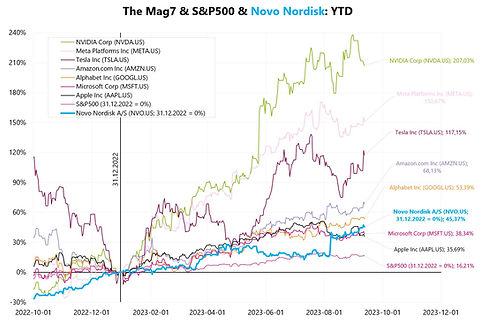

4-Dec-2023. The Mag7. 2023 YTD return. Of course, all seven companies beat the S&P500. The highest return since the beginning of the year is Nvidia +211%. The weakest Apple +46%. S&P500 only +19%. Figure 1. In October, the highest Microsoft +7.1%. The weakest is Tesla -19.7%. S&P500 -2.2%. In November, the highest was Tesla +19.5%. The weakest is Alphabet +6.8%. S&P500 +8.9%. Returns for the last two months combined (October + November): the highest Microsoft +20.0%. The weakest is Tesla -4.1%. S&P500 +6.5%. Figure 2. In the case of Microsoft, the last two months returns are the result of great results for Q3 2023 (link to earnings review below text). Similarly in the case of Tesla, poor Q3 results are making themselves felt... (link to earnings review below text).

Relative to S&P500 (Q3 2023)

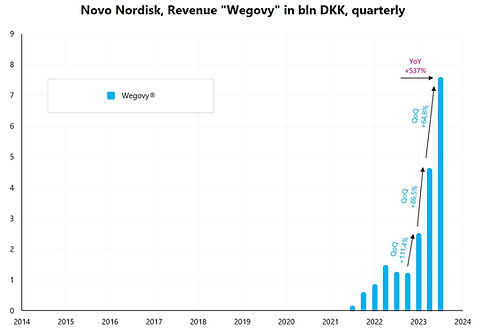

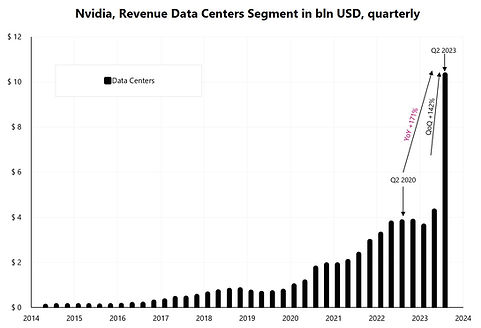

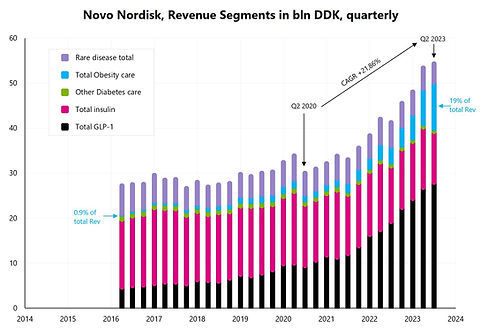

8-Dec-2023. Mag7 & Novo Nordisk. How do companies from the Mag7 club behave after the publication of results for Q3 2023? On average, neutral relative to the S&P500 (see the chart). 3 companies are above the S&P500 (Amazon, Microsoft, Apple), the rest are below. Yesterday, Alphabet rose 5.3% after announcing the launch of the new Gemini AI model (and here are the first tests of the model, including with a blue rubber duck: link below the text). Revenues for the entire S&P500 increased by 2.4% YoY in Q3, and EPS by 4.8%. In the table below the graph, I also include Wall Street's expectations for Q4 2023 earnings. Revenue dynamics in Q4 is expected to increase for Alphabet, Microsoft, Apple and Nvidia. The dynamics of profits (EPS) is expected to increase in Alphabet, Meta, Amazon and Novo Nordisk. On the subject of AI... Nvidia's revenues are expected to grow by ... 230% YoY and EPS by 410%. For the entire S&P500, revenues are expected to increase by 3.1% in Q4 and profits by 3.0%.

23-Oct-2023. Mag7+ How do individual companies perform after the publication of Q3 2023 earnings? From the date of publication to the closing price on November 22, 2023... the top outperformer is Amazon (+12.56% relative to the S&P500, and nominally +22.7%). Tesla is the weakest (-9.1% relative to the S&P500, and nominally -3.49%).

Relative to S&P500 (Q4 2023)

8-Dec-2023. Counting from the earnings publication for Q4 2022 (Tesla started the season on January 25, 2023), all companies from the Mag7 club, as well as the largest European company Novo Nordisk, beat to date the S&P500 (Figure 1), the most: Nvidia nominally +128.9% and +109.6% relative to the S&P500, Meta nominally +117.3% and +105.5% relative to the S&P500, Tesla nominally +68.8% and +54.2% relative to the S&P500, and the weakest: Alphabet nominally +25.3% and only +15.1% relative to the S&P500. Similarly, since the result publication for Q1 2023, all companies have also beaten the S&P500 (Figure 2). After the publication of Q2 2023 earnings, 4 companies beat the S&P500, 2 are neutral and 2 worse than the S&P500 (all calculations at prices as of December 8, 2023). After the publication of results for Q3 2023, only 3 companies have beaten the S&P500, the remaining 5 are behaving worse than the S&P500. If on January 25 we bought 7 companies from the Magnificent 7 club (in equal weights), our portfolio would earn 77.6% by December 8 (bottom panel of Figure 1). If we had a more conservative approach and bought according to weights depending on the capitalization of a given company (the largest is Apple, the smallest is Tesla), we would earn 65.2%. Historically, outperformance and higher valuations of the largest companies (aka nifty-fifty) lasted for years. Of course, after such increases, these companies now have a higher beta and can easily fall more than the S&P500 (e.g. the decline in October of the Mag7 (equal weights) was 2.9% (S&P500 -2.2%), but the rebound in November: Mag7 +11.9% and S&P500 +8.9%.

Alphabet Q2 2023 review

26-Jul-2023. Alphabet (Google) delivered very strong results for Q2, which at the same time turned out to be well above Wall Street expectations, so the share price is now 6-7% above yesterday's close (pre-market). In Q2, +4.4% YoY revenue growth was expected, and it was +7.1% (+ USD 4.9 bln)! The main contributors to revenue growth are Google Search (+4.8% YoY, +1.9 bln USD), Google Cloud (+28.0% YoY, +1.8 bln USD), and Google Other (+24.2% YoY, +$1.6 bln USD). Google Other are mainly YouTube nonadvertising revenues, primarily from subscription growth in YouTube Music, Premium, and YouTube TV, followed by growth in hardware revenues. The result conference call was mainly about AI. In virtually every aspect of business, the company can use / or already uses AI. Sundar Pichai, CEO: “At I/O (annual developer conference), we shared how we are making AI helpful for everyone in four important ways. First, improving knowledge and learning (…) we intuitively know how to incorporate AI into our products (…). This quarter saw our next major evolution with the launch of the Search Generative Experience, or SGE, which uses the power of generative AI to make Search even more natural and intuitive (…) Ads will continue to play an important role in this new search experience . Many of these new queries are inherently commercial in nature. Second, we are helping people use AI to boost their creativity and productivity. One example is Bard, our experiment in conversational AI. Since launching in March, it continues to get better. Third, we are making it easier for others to innovate using AI. One way is by providing Google Cloud's high-performance infrastructure, optimized for a range of generative AI models. Finally, we are making sure we develop and deploy AI technology responsibly.”

Alphabet Q3 2023 preview

24-Oct-2023. Alphabet. Q3 2023 earnings (short) preview. Today, after the market close, Alphabet will publish Q3 2023 earnings. Publishing its results for Q2 in July this year, Alphabet surprised Wall Street in a strongly positive way (+3% sales surprise and +9.1% EPS surprise). As a result of such earnings, Alphabet's stock performed the best of all Mag7 companies since the publication of Q2 results - Alphabet beat the S&P500 by as much as 19.4% - see chart 1. From 25-Jul-2023 to 23-Oct-2023: Alphabet +11.7%, S&P500 -7.7%, so Alphabet relative to S&P500 +19.36% (corresponding to S&P500 at the level of 5033.67 on October 20 - see chart 1). What are analysts' expectations regarding Q3 results: Revenue: $75.99 bln (+9.98%, was $69.09 bln in Q3 2022) – see chart 2. EPS: 1.45 (+38.8%, was 1.06 in Q3 2022).

Alphabet Q3 2023 review

25-Oct-2023. Alphabet. Earnings Q3 2023 review. Alphabet generally beat revenue expectations on every line except its Google Cloud segment: 1) Total Revenue: $76.69 bln (+0.92% Sales surprise, chart 1), 2) Revenue ex-TAC: $64.05 bln (+1.60% Sales surprise, chart 2), TAC – Traffic Acquisition Costs: the portion of revenues shared with Google’s partners and amounts paid to distribution partners and others who direct traffic to the Google website, 3) Google Cloud: $8.41 bln (-2.21% Sales surprise, chart 3). Google Cloud has been the key catalyst behind the company's growth on the back of its strengthening cloud service offerings. And this is a market segment with stiff competition. So negative surprise here is hurting. Google's cloud offerings include Google Cloud Platform and Google Workspace. 4) EPS $1.55 per share (+6.90% beat). So at this moment Alphabet is down 6.1% in after-hours trading.

25-Oct-2023. Alphabet. Earnings Q3 2023 review. Part 2. If lower-than-expected revenue growth in the Google Cloud segment resulted in a decline in the stock price (in after-hours), it is worth checking how it was commented during the earnings conference. And there were questions about the slowdown in this segment. Sundar Pichai, CEO: “ (…) On Cloud, maybe what I would say is, overall, we had definitely started seeing customers looking to optimize spend. We leaned into it to help customers given some of the challenges they were facing. And so that was a factor. But we are definitely seeing a lot of interest in AI. There are many, many projects underway now, just on Vertex alone, the number of projects grew over 7x. And so we see signs of stabilization, and I'm optimistic about what's ahead”. Ruth Porat, CFO: “Turning to the Google Cloud segment. Revenues were $8.4 billion for the quarter, up 22%. GCP (“Google Cloud Platform”) revenue growth remained strong across geographies, industries and products, although the Q3 year-on-year growth rate reflects the impact of customer optimization efforts. Google Workspace also delivered strong revenue growth, primarily driven by increases in average revenue per seat. Google Cloud had operating income of $266 million, and the operating margin was 3%.” “(…) as it relates to Cloud, as Sundar said, what we're really excited about is the revenue growth does reflect healthy customer adoption across the portfolio, and that's infrastructure, data analytics, security. And so we’re -- I can't comment on others, but we feel good about where we're sitting here and looking forward, and we'll let you do the forecasting. DCP growth in the third quarter was above the growth rate for Cloud overall, and we feel really good about the work that they're doing there. And then, of course, in addition to that is all of the contribution from Google Workspace.”

Alphabet Q1 2024 review

29-Apr-2024. Alphabet Q1 2024 earnings review My key takeaways: 1) Alphabet rose by more than 10% after the results announcement to a new all-time high. The results were very good and practically beat expectations across the board: +1.9% beat – Total Revenues of $80.54 billion (expected $79.0 billion), Figure 1, +2.6% beat – "Google Search & Others" revenues at the level of $46.16 billion (expected $45.0 billion), Figure 2, +4.7% beat – "YouTube Ads" revenues of $8.09 billion (expected $7.73 billion), Figure 3, +2.5% beat – "Google Advertising" revenues of $61.66 billion (expected $60.18 billion), Figure 4, +2.1% beat – "Google Cloud" revenues of $9.57 billion (expected $9.37 billion), Figure 5, 2) The main threat to Aplhabet is a possible change in users' preferences in using search engines and replacing them with popular AI chatbots that answer questions rather than provide links to other websites. Today, this threat is not visible in numbers, but the success of integrating the search engine with AI tools will be crucial here. Sundar Pichai, CEO: „AI innovations in Search are (…) perhaps the most important point I want to make. We have been through technology shifts before - to the web, to mobile and even to voice technology. Each shift expanded what people can do with Search and led to new growth. We are seeing a similar shift happening now with generative AI. (…) now, we’re starting to bring AI overviews to the main search results page. We are being measured in how we do this, focusing on areas where gen AI can improve the Search experience, while also prioritizing traffic to websites and merchants. (…) based on our testing, we are encouraged that we are seeing an increase in Search usage among people who use the new AI overviews, as well as increased user satisfaction with the results”. On SGE (search generative experience) and Search: “ (…) we are seeing early confirmation of our thesis that this will expand the universe of queries where we are able to really provide people with a mix of factual answers, linked to sources across the web and bring a variety of perspectives, all in an innovative way. And we have been rolling out AI overviews in the U.S. and U.K., trying to mainly tackle queries, which are more complex where we think SGE will clearly improve the experience.” 3) Alphabet showed good results in the Cloud segment, where YoY growth accelerated to 28% (+$2.12 billion YoY). Google Cloud generates revenues primarily from consumption-based fees and subscriptions received for Google Cloud Platform services, Google Workspace communication and collaboration tools, and other enterprise services. 4) Alphabet also showed a large CAPEX (purchases of property and equipment) in Q1 in the amount of $12.12 billion (expected $10.2 billion), but this did not disturb investors (in the case of Meta, the large CAPEX was cited as a negative factor). Additionally, full-year run-rate CAPEX will be at least at the Q1 level or higher, i.e. >$48 billion in 2024 (expected $43.1 billion). 5) To maintain good investor sentiment, Alphabet also announced the initiation of a cash dividend program, and declared a cash dividend of $0.20 per share that will be paid on June 17, 2024. The company intends to pay quarterly cash dividends in the future, subject to review and approval by the company's Board of Directors in its sole discretion. Additionally, Alphabet's Board of Directors authorized the company to repurchase up to an additional $70.0 billion of its Class A and Class C shares.

Alphabet Q2 2024 preview

22-Jul-2024. Alphabet Q2 2024 preview. Alphabet reports earnings after the market close on July 23. Wall Street expects: - revenues of $84.353 billion (this means YoY +13.1% and QoQ +4.7%) - revenues excluding TAC at the level of $73.203 billion (this means YoY +17.9% and QoQ +8.3%) - Google Cloud revenues at the level of $ 10.089 billion (this means YoY +25.6% and QoQ +5.4%) - diluted EPS at $ 1.84 (this means YoY +27.8% and QoQ -2.65%). Figure 1 shows the change in consensus regarding future revenues. After the publication of the results for Q1 2024, the revenue forecast decreased by 0.7% to 3.2% (change from April 19 to May 15). However, the consensus as of July 22 is already higher (than the one from May 15) from 1.7% to 2.7%. Figure 2 shows the Wall Street consensus on EPS estimate for each quarter. Figure 3 additionally shows the company's reported EPS. Whereas Figure 4 shows EPS starting from October 2023.

Alphabet Q2 2024 review

28-Jul-2024. Alphabet Q2 2024 earnings review. During earnings call the word “AI” was mentioned 91 times (“only” 65 times during Q1 2024 call). The best summary of Q2 2024 results is as follows: 1) Strong business performance, especially in Search and Cloud, 2) Strong AI investment and leadership, 3) Many examples of AI use at both the consumer and enterprise level, but it is still too early for (wide) monetization of AI. Alphabet beat the revenue consensus for the 6th quarter in a row, in Q2 2024 Wall Street expected $84.35 billion, Alphabet delivered $84.74 billion (+0.5% beat). See Figure 1. Other key data: -2.5% miss: “Revenues excluding TAC” $71.36 billion (expected $73.20 billion), Figure 2, +1.8% beat: "Google Search & Others" revenues $48.509 billion (expected $47.638 billion), Figure 3, -3.2% miss: "YouTube Ads" revenues of $8.663 billion (expected $8.946 billion), Figure 4, -5.5% miss: "Google Network" revenues of $7.44 billion (expected $7.87 billion), Figure 5, +0.2% beat: "Google Advertising" revenues of $64.616 billion (expected $64.518 billion), Figure 6, +2.6% beat: "Google Cloud" revenues of $10.347 billion (expected $10.088 billion), Figure 7, +2.7% beat: EPS diluted $1.89, estimate $1.84, Figure 8 Sundar Pichai, CEO: “(…) we are uniquely well-positioned for the AI opportunity ahead. Our research and infrastructure leadership means we can pursue an in-house strategy that enables our product teams to move quickly. Combined with our model building expertise, we are in a strong position to control our destiny as the technology continues to evolve. Importantly, we are innovating at every layer of the AI stack, from chips to agents and beyond, a huge strength”. On Google Search: “With AI, we are delivering better responses on more types of search queries and introducing new ways to search. We are pleased to see the positive trends from our testing continue as we roll out AI Overviews, including increases in Search usage and increased user satisfaction with the results. People who are looking for help with complex topics are engaging more and keep coming back for AI Overviews”. On Waymo (autonomous ride-hailing service): “Waymo served more than 2 million trips to date and driven more than 20 million fully autonomous miles on public roads. Waymo is now delivering well over 50,000 weekly paid public rides, primarily in San Francisco and Phoenix. And in June, we removed the wait list in San Francisco, so anyone can take a ride. Fully autonomous testing is underway in other Bay Area locations without a human in the driver seat”. AI will take some time… to unlock value: “ (…) if you take a look at our AI infrastructure and generative AI solutions for cloud across everything we do, be it compute on the AI side, the products we have through Vertex AI, Gemini for Workspace and Gemini for Google Cloud, etc., we definitely are seeing traction. People are deeply engaging with the Gemini models across Vertex and AI studio. We now have over 2 million developers playing around with these things, and you are definitely seeing early use cases. But I think we are in this phase where we have to deeply work and make sure on these use cases, on these workflows, we are driving deeper progress on unlocking value, which I'm very bullish will happen. But these things take time. But if I were to take a longer-term outlook, I definitely see a big opportunity here”. On the AI capex: “I think the one way I think about it is when we go through a curve like this, the risk of under-investing is dramatically greater than the risk of over-investing for us here, even in scenarios where if it turns out that we are over-investing, we clearly -- these are infrastructure which are widely useful for us. (…) But I think not investing to be at the front here, I think, definitely has much more significant downside”.

Alphabet Q3 2024 review

31-Oct-2024. Alphabet Q3 Earnings Review. The market rewarded the good results and Alphabet's share price grew even more than 7%, but finally closed the first day of trading after the results with an increase of 2.85% (S&P500 -0.33%). My key takeaways: 1) Firstly, very good results vs Wall Street expectations, practically beating across the board, 2) Secondly, 35% YoY growth of Google Cloud, with Q3 revenues at $11.35 billion (+5.2% beat vs expectations of $10.79 billion), 3) Thirdly, wide adoption of GenAI, which is starting to bring business effects (AI is starting to "work" in every product line), 4) Of course, one should remember the earlier drop in the price from 191.75 (ATH, July 10) to the bottom of 147.2 (September 9) by 23%, then the price rose to 161 on October 24 - in such a context, it is easier to get a positive market reaction (similarly with Tesla after the publication of results). Additionally, in the 3 days prior to the publication of the results (October 24 to 29), Alphabet rose by 4.33% (S&P500 +0.4% for the same period) – which can also be considered a kind of front-running of good results. Sundar Pichai, CEO on an AI virtuous cycle: “(…) investment in AI are paying off (…) We are uniquely positioned to lead in the era of AI because of our differentiated full stack approach to AI innovation, and we are now seeing this operate at scale. It has three components. First, a robust AI infrastructure that includes data centers, chips and a global fiber network. Second, world-class research teams who are advancing our work with deep technical AI research and who are also building the models that power our efforts. And third, a broad global reach through products and platforms that touch billions of people and customers around the world, creating a virtuous cycle.” One can only imagine what would have happened to products and platforms if Alphabet had not invested in AI. Figure 1 shows Google Search & Other revenue Figure 2 shows YouTube Ads revenue Figure 3 shows Google Network revenue Figure 4 shows Google Advertising revenue (Google Search & Other + YouTube Ads + Google Network) Figure 5 shows Google subscriptions, platforms, and devices revenue Figure 6 shows Google Services Total revenue (Google Advertising + Google subscriptions, platforms, and devices) Figure 7 shows Google Cloud revenue Figure 8 shows Alphabet revenue (Google Services Total + Google Cloud + Other Bets + Hedging gains/losses) Figure 9 shows Alphabet revenue ex TAC (traffic acquisition cost).

Alphabet Q4 2024 Review

7-Feb-2025. Alphabet generally showed solid results in Q4, but slightly below expectations for total revenue (0.16% miss) – see Figure 1. But the most important thing was the miss on Google Cloud (a whopping 1.93%) – see Figure 2. The main reason for lower revenue was supply constraints, which prevented Alphabet from meeting the high demand related to AI (negative in the short term, however positive in the long term). Anat Ashkenazi, CFO: “On the Cloud question, first, I'm excited that we ended the quarter at $12 billion and a 30% year-over-year growth. Very impressive growth. And as I've mentioned in the prepared remarks, GCP grew at a much higher rate than overall Cloud. Two items to think about from a deceleration perspective, the first is we are lapping a very strong quarter [in] AI deployments in Q4 2023. The second is the one you've alluded to. We do see and have been seeing very strong demand for our AI products in the fourth quarter of 2024. And we exited the year with more demand than we had available capacity. So we are in a tight supply-demand situation, working very hard to bring more capacity online. As I mentioned, we've increased investment in CapEx in 2024, continuing to increase in 2025. And we'll bring more capacity throughout the year”. Alphabet spent $14 billion on CapEx in Q4 2024, but Capex will increase significantly in 2025. Anat Ashkenazi, CFO: “Ss we expand our AI efforts, we expect to increase our investments in capital expenditure for technical infrastructure, primarily for servers, followed by data centers and networking. We expect to invest approximately $75 billion in CapEx in 2025, with approximately $16 billion to $18 billion of that in the first quarter.” Finally, Sundar Pichai, CEO, commented on DeepSeek: “A couple of things I would say are, if you look at the trajectory over the past three years, the proportion of the spend towards inference compared to training has been increasing, which is good, because obviously inference is to support businesses with good ROIC. And so I think that trend is good. I think the reasoning models, if anything, accelerates that trend, because it's obviously scaling upon inference dimension as well. And so, look, I think part of the reason we are so excited about the AI opportunity is we know we can drive extraordinary use cases, because the cost of actually using it is going to keep coming down, which will make more use cases feasible, and that's the opportunity space. It's as big as it comes, and that's why you're seeing us invest to meet that moment.”

Amazon Q2 2023 review

5-Aug-2023. Amazon Q2 2023 results. Key takeaways: 1) Amazon definitely beat market expectations regarding revenue growth, YoY revenue increased by +10.8% in Q2 2023 (market expected +8.6%), additionally, the company forecasts revenue growth in Q3 of +10.5% (and the market expected only +8.8%) 2) The AWS (Amazon Web Services) segment showed revenue growth of +12.2% YoY (market expected +10.0%). This is an important segment, investors feared a larger decline in sales here due to customers still cutting IT costs - but this segment has stabilized since May and there is no further slowdown. In Q1, AWS grew 16%, but during the earnings conference, the company reported a decrease in AWS sales growth by 5 points down in April 2023 alone - which caused Amazon's share price to fall. The good news is that in Q3 we can expect a continuation of the trend from Q2. CFO, Brian Olsavsky: “(…) April was running about 500 basis points lower than Q1. What we've seen in the quarter is stabilization and you see the final 12% growth. (…) So, while that is 12%, there's a lot of cost optimization dollars that came out and a lot of new workloads and new customers that went in. (…) What we're seeing in the quarter is that those cost optimizations, while still going on, are moderating, and many maybe behind us in some of our large customers. And now we're seeing more progression into new workloads, new business. So, those balanced out in Q2. We're not going to give segment guidance for Q3. But what I would add is that we saw Q2 trends continue into July. So, generally feel the business has stabilized.” 3) Amazon delivered further improvement in retail margins in Q2 with “North America” segment operating margin up for 5th consecutive quarter and “International” segment up for 3rd quarter in a row 4) As for AI monetization, it will be rather slow… CEO Andy Jassy: “I think when you're talking about the big potential explosion in generative AI, which everybody is excited about, including us, I think we're in the very early stages there. We're a few steps into a marathon in my opinion. I think it's going to be transformative, and I think it's going to transform virtually every customer experience that we know. But I think it's really early. I think most companies are still figuring out how they want to approach it. They're figuring out how to train models. They want to -- they don't want to build their own very large language models. They want to take other models and customize it and services like (Amazon) Bedrock enable them to do so. But it's very early, and so I expect that will be very large, but it will be in the future.”

Amazon Q3 2023 review

28-Oct-2023. Amazon. Q3 earnings review. The day after the results were published, Amazon's price jumped +6.8% nominally and +7.31% relative to the S&P500. These are the second quarterly results in a row that were very well received by investors. Since the announcement of the results for Q2 (3-Aug-2023), Amazon's price is +7.6% relative to the S&P500 (and nominally -0.91%), see chart 1 and 2. My two key takeaways on Q3 2023 earnings, a kind of “big picture” to memorize: 1) Revenue beat, both just reported Q3 and Q4 2023 revenue guidance 2) All operational margins up! Additionally what’s also important: 3) In minus, a bit lower AWS (Amazon Web Services) revenues 4) In plus, nicely growing Advertising business segment 5) Of course, strong EPS beat and free cash flow 6) And more positive news about Generative AI (during earnings conference call) Re. 1) Amazon reported Q3 Total Revenue of $143.08 billion (+0.97% beat of Wall Street estimate), which gives an annual change of +12.6%. The company forecasts revenues in Q4 in the range of $160-167 billion, Wall Street expected $157 billion (beat +1.9% to +6.4%), chart 3. Re. 2) All operating margins increased YoY and sequentially quarter over quarter. Gross margin increased +286 bps YoY. See chart 4. Brian Olsavsky (CFO) during conference call on North America segment profitability: “North America operating income was $4.3 billion, an increase of $4.7 billion year over year, resulting in an operating margin of 4.9%, up 100 basis points quarter over quarter (…) The third quarter marked the second full quarter of regionalization within the U.S., and we're pleased with the early results. Regionalization has allowed us to simplify the network by reducing the number of line-haul lanes, increasing volume within existing line-haul lanes and adding more direct fulfillment center to delivery station connections. We have also been focused on optimizing inventory placement in a new regionalized network, which when coupled with the simplification mentioned earlier, is helping contribute to an overall reduction in cost to serve. Additionally, in the quarter, we saw benefits from lower inflation, primarily within line haul, ocean and rail shipping rates, which were partially offset by higher fuel prices” And on International segment: “In international, we were closer to breakeven during the quarter with an operating loss of $95 million. This was an improvement of $2.4 billion year over year. This improvement was primarily driven by lowering our cost to serve through higher productivity, decreased inflationary pressures and improvements in leverage across our established and emerging international countries” And on AWS (Amazon Web Services): “Our operating margin for the quarter was 30.3%. This is an improvement of approximately 600 basis points quarter over quarter, primarily driven by increased leverage on our headcount costs.”

28-Oct-2023. Amazon. Q3 earnings review. Part 2. What was a minor disappointment in the Q3 results was that AWS's cloud segment revenues grew below expectations (although the negative surprise was only 0.3%) - see chart 1. And this segment also contains all of the future artificial intelligence growth. Maybe the revenue miss was small, but if we look at the growth in this segment over the last 4 quarters and compare it to the growth of Microsoft's Intelligent Cloud... so Amazon is slightly behind Microsoft, see chart 2 (in Q3 2022, Amazon's revenues were $213m higher than Microsoft's ones - and in Q3 2023 Microsoft's revenues are $1.2b higher). My key takeaways: 1) Based on the company's comments during the earnings call and general optimism surrounding AWS's prospects, AWS's current slower revenue growth may look like a "temporary blip", 2) AWS's very good prospects should be looked at in two dimensions: (i) "cloud is early" and (ii) "generative AI is very early" - that is, not only generative AI is at an early stage of development, but also cloud... (despite that today's "run rate" of this business for Amazon is $92 billion per year), 3) The development of Generative AI is also a big challenge for Amazon’s customers: large models turn out to be expensive, their practical use is complicated, and most customers do not have experienced AI experts. Andy Jassy, Amazon’s CEO: “If you think about 90% plus of the global IT spend being on-premises, where I think that equation is going to flip in 10 years. I think cloud is early. So, if you -- with that lens on, I still think we're very early in generative AI.” Andy Jassy on some challenges of large AI models: “a lot of companies figure out quickly is that using the really large -- the large models and the large sizes ends up often being more expensive than what they anticipated and what they want to spend on that application. And sometimes too much latency in getting the answers as it shovels through the really large models.” “still it's complicated to actually figure out which models you want to work, you want to use and how you actually want to employ them and trying to make sure you have the right results, trying to make sure you get safe results, trying to make sure you end up with a cost structure and a customer experience that you want. And so, it's hard. And customers will like -- there's a certain number of customers who have very deep AI expert practitioners, but most companies don't.”

Amazon Q1 2024 review

1-May-2024. Amazon Q1 2024 earnings review My key takeaways: 1) Total revenues increased by 12.5% YoY (above expectations, but only +0.51% beat), but at the same time the company's guidance for Q2 disappointed ... mid-range is only $146.5 billion, which means a 2.46% miss - see Figure 1. The "North America" segment performed slightly better +0.83% beat - see Figure 2. However, the "International" segment was disappointing - 1.57% miss - Figure 3. 2) But the most important segment for investors, AWS (amazon web services), was the strongest! Beating expectations by as much as 3.81% - see Figure 4. YoY growth accelerated to 17.2% (from 13.2% in Q4 2023). Figure 5 shows a comparison of the cloud businesses of Microsoft and Google. About AWS, Andy Jassy, CEO: “We remain very bullish on AWS. We're at $100 billion-plus annualized revenue run rate, yet 85% or more of the global IT spend remains on-premises. And this is before you even calculate GenAI, most of which will be created over the next 10 to 20 years from scratch and on the cloud.” „We're seeing a few trends right now. First, companies have largely completed the lion's share of their cost optimization and turned their attention to newer initiatives (…) Our AWS customers are also quite excited about leveraging GenAI to change the customer experiences and businesses. We see considerable momentum on the AI front” About 3 layers of GenAI: “(…) we continue to add capabilities at all three layers of the GenAI stack. At the bottom layer, which is for developers and companies building models themselves, we see excitement about our offerings. We have the broadest selection of NVIDIA compute instances around, but demand for our custom silicon, training, and inference is quite high, given its favorable price performance benefits relative to available alternatives (…) The middle layer of the stack is for developers and companies who prefer not to build models from scratch, but rather seek to leverage an existing large language model, or LLM, customize it with their own data, and have the easiest and best features available to deploy secure high-quality, low-latency, cost-effective production GenAI apps. This is why we built Amazon Bedrock (…) Bedrock already has tens of thousands of customers, including Adidas, New York Stock Exchange, Pfizer, Ryanair, and Toyota. In the last few months, Bedrock's added Anthropic's Claude 3 models, the best-performing models in the planet right now; Meta's Llama 3 models; Mistral's Various models, Cohere's newest models, and new first-party Amazon Titan models. (…) The top of the stack are the GenAI applications being built. And today, we announced the general availability of Amazon Q, the most capable generative AI-powered assistant for software development and leveraging company's internal data. On the software development side, Q doesn't just generate code, it also tests code, debugs coding conflicts, and transforms code from one form to another. Today, developers can save months using Q to move from older versions of Java to newer, more secure and capable ones.” 3) Margins are up significantly! Gross margin and operating margin are the highest in recent years. AWS margins have also increased to historic levels. See Figure 6. 4) Capex is up significantly! Of course, just like in Tesla, Alphabeth, Microsoft, Meta – it's mainly AI related! CEO: „We expect the combination of AWS' reaccelerating growth and high demand for GenAI to meaningfully increase year-over-year capital expenditures in 2024, which given the way the AWS business model works is a positive sign of the future growth. The more demand AWS has, the more we have to procure new data centers, power and hardware. And as a reminder, we spend most of the capital upfront. But as you've seen over the last several years, we make that up in operating margin and free cash flow down the road as demand steadies out. And we don't spend the capital without very clear signals that we can monetize it this way.” Brian Olsavsky, CFO: “As a reminder, we define these as the combination of capex plus equipment finance leases. In 2023, overall capital investments were $48.4 billion. As I mentioned, we're seeing strong AWS demand in both generative AI and our non-generative AI workloads, with customers signing up for longer deals, making bigger commitments. (…) We anticipate our overall capital expenditures to meaningfully increase year over year in 2024, primarily driven by higher infrastructure capex to support growth in AWS, including generative AI.”

Amazon Q4 2024 review

11-Feb-2025. Amazon’s 2025 CAPEX? Try $105bln! The positives include generally solid results in Q4 2024 and growing margins, while the negatives include slightly weaker AWS revenues in Q4 2024 and weaker-than-expected guidance for Q1 2025. First, Amazon shares beat the S&P500 by 21% between the publication of Q3 2024 and Q4 2024 results (i.e. from October 31, 2024 to February 6, 2025), which is enough to make us expect a pause for now... (such performance also boosted market expectations for Q1 2025). Figure 1 shows Amazon's relative performance to the S&P500 after the publication of subsequent quarterly results. As a rule, underperformance is small (as in the period after the publication of Q1 and Q2 2024 results), while overperformance can be large... as a result, Amazon beat the S&P500 by a cumulative 61 percentage points... counting from the publication of Q4 2022 results (i.e. from February 2, 2023 to February 10, 2025 - see Table 1). In Q4 2024, Amazon beat expectations regarding total revenue (Figure 2) and margin (Figure 3). AWS did slightly worse (Figure 4). AWS has about a 35% share of the global cloud market. On the other hand, Amazon disappointed with its guidance for Q1 2025: -net sales are expected to be $151.0 billion to $155.5 billion, below the estimate of $158.64 billion, and -operating income $14.0 billion to $18.0 billion, below the estimate of $18.24 billion CAPEX in 2025 is impressive... as much as $105bn - with Wall Street expecting only $86bn. That's more in 2025 than Meta ($60-65bn), Alphabet ($75bn) and Mircrosoft (some $88bn in 2025FY). Andrew R. Jassy , CEO: “Capital investments were $26.3 billion in the fourth quarter. And we think that run rate will be reasonably representative of our 2025 capital investment rate. Similar to 2024, the majority of the spend will be to support the growing need for technology infrastructure. This primarily relates to AWS, including to support demand for our AI services, as well as tech infrastructure to support our North America and international segments. Additionally, we're continuing to invest and capacity for our fulfillment and transportation network to support future growth. We're also investing in same-day delivery facilities and our inbound network, as well as robotics and automation, to improve delivery speeds and to lower our cost to serve. These capital investments will support growth for many years to come.” Amazon is quite optimistic about AI, which is “the biggest opportunity”: “And while it may be hard for some to fathom a world where virtually every app has generative AI infused in it, with inference being a core building block just like compute, storage, and database, and most companies having their own agents that accomplish various tasks and interact with one another, this is the world we're thinking about all the time. And we continue to believe that this world will mostly be built on top of the cloud with the largest portion of it on AWS. (…) AI represents, for sure, the biggest opportunity since cloud and probably the biggest technology shift and opportunity in business since the Internet”. And Amazon could have been growing faster: “It is hard to complain when you have a multibillion-dollar annualized revenue run rate business in AI, like we do, and it's growing triple-digit percentage year over year. It's hard to complain. However, it is true that we could be growing faster, if not for some of the constraints on capacity. And they come in the form of, I would say, chips from our third-party partners, come a little bit slower than before with a lot of midstream changes that take a little bit of time to get the hardware actually yielding the percentage healthy and high-quality servers we expect”. And some comments on DeepSeek: “First of all, I think like many others, we were impressed with what DeepSeek has done. I think in part impressed with some of the training techniques, primarily in flipping the sequencing of reinforcement training -- reinforcement learning being earlier and without the human-in-the-loop. We thought that was interesting ahead of the supervised fine-tuning. We also thought some of the inference optimizations they did were also quite interesting. For those of us who are building frontier models, we're all working on the same types of things and we're all learning from one another. (…) if you run a business like AWS and you have a core belief like we do, that virtually all the big generative AI apps are going to use multiple model types, and different customers are going to use different models for different types of workloads. You're going to provide as many leading frontier models as possible for customers to choose from. That's what we've done with services like Amazon Bedrock. And it's why we moved so quickly to make sure that DeepSeek was available both in Bedrock and in SageMaker faster than you saw from others”.

Apple Q2 2023 review

4-Aug-2023. Apple Q2 2023 results. As expected, it's a bit of a boring quarter for Apple's earnings. However, there are 3 things to note: 1) Constantly decreasing revenue growth. YoY revenue decreased by 1.4% (with 4 percentage points of FX headwind), the forecast for Q3 is a similar decline in YoY (-1.4%), but FX will subtract only 2 percentage points - i.e. revenue decline accelerates on a constant currency basis. 2) But in return, the profitability of the business is growing and the gross margin in Q2 was the highest in history 44.5% Luca Maestri, CFO: “(…) the 44.5% for the June quarter is an all-time record for us in June. We were up 20 basis points sequentially. It was driven by cost savings and a mix shift towards Services, which obviously helps company gross margins, partially offset by the seasonal loss of leverage. We have a commodity environment that is favorable to us. Our product mix is quite strong at this point. (…) we expect a similar level of gross margins for the same reasons, frankly, for the September quarter.” 3) In order to somehow justify the company's high valuation, "everyone is focused" on current and future growth drivers ... such as: - increase in sales in Emerging Markets, - affordability programs - various forms of crediting/sales promotion, - growth of Services, - AI, very important, but there will be no super breakthrough here, - new products, such as Vision Pro Timothy Cook: “There's enormous excitement around the Vision Pro. We're excited internally. Everybody that's been through the demos are blown away, whether you're talking about press or analysts or developers. (…) I'm using the product daily”. All in all, it is difficult to justify today's valuation of Apple from the financial point of view and the company's (short/medium-term) growth potential. The valuation premium simply depends on other factors…

Apple is down 8.96%

8-Aug-2023. Apple is down 8.96% from the recent high, and since it is the largest company, it necessarily has a large impact on the entire market. Weaker financial results for Q2 2023 took their toll.. However, after previous quarterly results, Apple usually outperformed the S&P500 in style: Q1 2023: +4.69% APPL next day +1.85% S&P500 next day Q4 2022: +2.44% APPL next day -1.04% S&P500 next day Q3 2022: +7.56% APPL next day +2.46% S&P500 next day Q2 2022: +3.28% APPL next day +1.42% S&P500 next day Q1 2022: -3.66% APPL next day -3.63% S&P500 next day .. but not today: current quarter Q2 2023: -4.80% APPL next day -0.53% S&P500 next day

two bad days -6.4%

8-Sep-2023. Apple's share price had two bad days in a row (-6.4% and the S&P500 only -1.0%). And one of the famous sayings is “As Apple goes … goes the market”. The iPhone ban in China is the main reason to blame. But let's also remember about the weak Q2 results. Revenues from China (Greater China Revenue Segment) constitute 19.3% of total revenues. Moreover, this segment's YoY growth is 7.9% in Q2 2023, while total revenues contracted by 1.4% in Q2 YoY (chart). Attached are some charts.

Apple Q3 2023 review

6-Nov-2023. Apple. Q3 2023 (calendar) results review (it was formally Q4 2023 for Apple). My 3 main takeaways: 1) The results were rather poor, generally slightly below expectations, and the most important thing... the company is not growing: this is the 4th quarter in a row of decline in YoY revenues, 2) the guidance for Q4 2023 means 0% YoY revenue growth (supposedly an improvement, but Wall Street expected +5%), let's also remember about high inflation when it is relatively easier to achieve nominal revenue growth 3) However, the market does not care too much: since the results were announced, Apple's share price is only 1.46% down relative to the S&P500. Apple has had periods of revenue decline like this before (see the chart, top panel): 1) In 2016, TTM (12-month trailing) revenues decreased by 8.3%. Then came the recovery on TTM sales +23.9% (mainly due to the increase in iPhone sales) 2) In 2019, TTM revenues decreased by 2.7%. Then came a weak rebound in TTM sales of +6.2% (mainly due to the increase in sales of Services and Wearables+) 3) Strong growth 2020-22, TTM revenues increased +43.6% (mainly due to growth in iPhone and Services sales) TTM's current revenue decline YoY is 2.8%. For Apple to make another jump in revenues, it will probably need a significant increase in iPhone sales again... Weaker sales in China do not help either, which in Q3 turned out to be as much as USD 2 billion below Wall Street's expectations. ------------------------ Some more color on revenue growth: it’s fair to say that the strong dollar reduced Apple's sales expressed in USD both in Q3 and the entire fiscal year (last 4 quarters). Foreign exchange had a negative impact of over 2 percentage points in September quarter, and some 3 points over the full reporting year. So, on constant-currency basis it was 0+ revenue growth. Similarly, in China, negative FX impact was nearly 6 points in September quarter. Attention should also be paid to shifts between quarters in the sales of new product versions, as well as shifts related to supply chain disruptions. This especially applies to Mac and iPad sales, which moved from Q2 to Q3 in 2022 – so Q3 YoY comparison is a little bit flawed.

Apple Q4 2023 review

5-Feb-2024. Apple December 2023 quarter earnings review. Part 1. Will the latest technological marvel, Vision Pro glasses, save Apple this year? Apple Vision Pro is available in U.S. stores starting Friday, February 2. There is no doubt about customer delight, but sales volume will be important for investors. This product has the potential to drive the company's revenue growth in 2024. Yet, the lack of significant growth or even the risk of a decline in revenues is the company's main challenge and the main risk for investors that at some point the share price may react negatively. My key takeaways form recent earnings release: 1) Apple's total sales in Q4 2023 grew only 2.1% year-over-year. But in Q4 2022, due to disruptions in supply chains, iPhone sales were approximately $5 billion lower, and this demand was only met in Q1 2023. In other words, $5 billion in sales moved from Q4 2022 to Q1 2023. If we take this effect into account in the comparison of Q4 2022 and Q4 2023, instead of a 2.1% increase we would get a 2.1% decrease in sales. Since nothing in nature is lost, we will formally see this effect in the decline in sales in the first quarter of 2024. And now the analysts' consensus forecast of Apple's revenues in the calendar Q1 2024 is USD 92.5 billion, which means a year-on-year decline of 2.5% - see Figure 1. Figure 2 shows the dollar contributions to the annual change in revenues – by business segments. iPhone added USD 3.9 billion, but if we added USD 5 billion in sales to Q4 2022 - the contribution would be negative. 2) Apple is making up for the lack of sales growth with higher gross profit margin, which has increased from levels of around 38% in 2020 to the current 45.9%. Apple forecasts its further growth in calendar Q1 2024 to the range of 46-47% - see Figure 3. 3) Weak sales in China are a concern (Figure 4). Well-known Apple analyst from TF International Securities, Ming-Chi Kuo recently stated that the new paradigm in phone design includes the use of artificial intelligence and foldable phones, and the main reason for the decline in Apple sales on the Chinese market is the growing interest in foldable phones (which Huawei benefits from). According to Ming-Chi Kuo, shipments of iPhone 15 series and new iPhone 16 series will decline by 10-15% y/y in the first and second half of 2024, respectively.

5-Feb-2024. Apple earnings review. Part 2. Continuation of part one: In turn, at the beginning of January 2024, Barclays analysts lowered their recommendations for Apple to "underweight" with a target price of $160. Analysts expect weaker iPhone sales (both in terms of volume and sales mix), and no rebound in Mac, iPad and Wearables. Weaker sales in China in particular will weigh on results. In the case of Mac and iPad, sales may fall to pre-pandemic levels: "These two products combined were basically showing no growth pre-Covid, but are still running 20-30% above those levels despite the rest of the industry correcting." See Figure 5 and 6. Additionally, Barclays analysts expect some deceleration in Services, with regulatory risk ramping. “We model ~10% and ~8%growth in Services in FY24 and FY25, well below prior growth estimate of ~20%. In 2024, we should get an initial determination on the Google TAC, and some app store investigations could intensify.” See Figure 7. So what can have a positive impact on Apple in 2024? Apple Vision Pro will certainly be sold, not only to retail but also commercial customers. Luca Maestri, CFO Apple during the results conference: “Leading organizations across many industries such as Walmart, Nike, Vanguard, Stryker, Bloomberg, and SAP have started leveraging and investing in Apple Vision Pro as their new platform to bring innovative spatial computing experiences to their customers and employees. From everyday productivity to collaborative product design to immersive training, we cannot wait to see the amazing things our enterprise customers will create in the months and years to come.” In the field of artificial intelligence, Apple - unlike other companies - does not provide greater details, but announced that in 2024 it will show what steps the company has taken in this regard. Market expectations in this area are very high. Tim Cook, CEO of Apple during the earnings conference: “As we look ahead, we will continue to invest in these and other technologies that will shape the future. That includes artificial intelligence where we continue to spend a tremendous amount of time and effort, and we're excited to share the details of our ongoing work in that space later this year.” Tim Cook on the high price of Apple Vision Pro: “(…) from a price point of view, there's an incredible amount of technology that's packed into the product. There's 5,000 patents in the product and it's, of course, built on many innovations that Apple has spent multiple years on, from silicon to displays and significant AI and machine learning. All the hand tracking, the room mapping, all of this stuff is driven by AI. And so, we're incredibly excited about it. I can't wait to be in the store for tomorrow and see the reaction myself.”

Apple Q1 2024 review

4-May-2024. Apple March Quarter 2024 Earnings Review My key takeaways: 1) First, it's going to be flat nominal growth at best. And this in an environment of high inflation. Investors should probably get used to this. The company is too large for any new and innovative products to significantly accelerate the growth of total revenues (in the short term). 2) If investors "accept flat growth" - then practically all other important factors related to the company are fine and solid - starting from a strong brand, customer satisfaction, market position, margins, further products, Vision Pro, expectations regarding AI applications, growing dividend and increasingly larger share buybacks, etc. Tim Cook, CEO: „In services, we set an all-time revenue record, up 14% over the past year. Keep in mind, as we described on the last call, in the March quarter a year-ago, we were able to replenish iPhone channel inventory and fulfill significant pent-up demand from the December quarter COVID-related supply disruptions on the iPhone 14 Pro and 14 Pro Max. We estimate this one-time impact added close to $5 billion to the March quarter revenue last year. If we remove this from last year's results, our March quarter total company revenue this year would have grown.” And about GenAI: „We continue to feel very bullish about our opportunity in Generative AI. We are making significant investments, and we're looking forward to sharing some very exciting things with our customers soon. We believe in the transformative power and promise of AI, and we believe we have advantages that will differentiate us in this new era, including Apple's unique combination of seamless hardware, software and services integration, groundbreaking Apple's silicon, with our industry-leading neural engines and our unwavering focus on privacy” And the remaining takeaways: 3) Revenues decreased YoY by 4.8% and this is the 5th quarter of negative annual growth over the last 6 quarters - see Figure 1. A year ago, approximately $5 billion in iPhone sales moved from Q4 2022 to Q1 2023 - if we adjusted the results for this, then Q4 would be negative (-2.1%) and the current quarter positive (+1.02%). It is also worth noting the significant decline in Wall Street expectations regarding Apple's revenue growth - see Figure 2 (and comparison of the consensus change from February to April 2024). 4) Year over year, Apple recorded revenue growth only on Mac sales (+$0.28 billion YoY) and Services (+$2.96 billion) - see Figure 3. The remaining product categories were negative year over year - see Figure 4. 5) To counterbalance and somehow satisfy shareholders... Apple increased its share buyback program to $110 billion and also increased its dividend by 4% to $0.25 per share. 6) Revenues may not be growing as investors would like, but in return the gross profit margin is constantly growing - and in Q1 it reached as much as 46.6% - see Figure 5. This is due to growing margins in services (and falling margins on products) - see Figure 6. Luca Maestri, CFO: „Company gross margin was 46.6%, up 70 basis points sequentially, driven by cost savings and favorable mix to services, partially offset by leverage. Products gross margin was 36.6%, down 280 basis points sequentially, primarily driven by seasonal loss of leverage and mix, partially offset by favorable costs. Services gross margin was 74.6%, up 180 basis points from last quarter due to a more favorable mix.” 7) Investors pay a lot of attention to the Chinese market (there were a lot of questions about China at the results conference). Sales in the Chinese market decreased YoY by 8.1% (-$1.44 billion). This is a smaller decline than in the previous quarter, when it amounted to -12.9%. See Figure 7. However, the company remains optimistic about the Chinese market… Tim Cook: „(…) if you look at our results in Q2 for Greater China, we were down 8%. That’s an acceleration from the previous quarter in Q1. And the primary driver of the acceleration was iPhone. And if you then look at iPhone within Mainland China, we grew on a reported basis. That’s before any kind of normalization for the supply disruption that we mentioned earlier. And if you look at the top-selling smartphones, the Top 2 in Urban China are iPhones. And while I was there, it was a great visit and we opened a new store in Shanghai and the reception was very warm and highly energetic (…). And so I maintain a great view of China in the long-term. I don’t know how each and every quarter goes and each and every week. But over the long haul, I have a very positive viewpoint.”

Apple Q4 2024 Review

4-Feb-2025. Apple Intelligence – a game changer? In general, Apple showed weak results for the calendar 4th quarter of 2024 (some say better than feared). The most disappointing were sales in China… where revenues fell 11% YoY. Nevertheless, the next quarter may be a bit better… the company expects YoY revenue growth of “low to mid single digits” – and this is after deducting the effect of the strong dollar, which will take away as much as 2.5 points from the annual change in sales. Kevan Parekh, CFO: “The color we're providing today assumes that the macroeconomic outlook doesn't worsen from what we're projecting today for the current quarter. As the dollar strengthens significantly, we expect foreign exchange to be a headwind and to have a negative impact on revenue of about 2.5 percentage points on a year-over-year basis. Despite that headwind, we expect our March quarter total company revenue to grow low to mid single digits year over year. We expect services revenue to grow low double digits year over year.” Apple... on the negative side there is lack of revenue growth + problems in China, but on the positive side we have a strong brand, 2.35 billion of active devices (customer base) and the ability to offer this customer base AI services (Apple Intelligence). Can Apple Intelligence trigger another sales upgrade wave of the latest iPhone models? At least that's what investors are counting on.. and introducing Apple Intelligence to the market will take some time (e.g. preparing different language versions). In addition (or maybe it's a good thing) Apple Intelligence is only available on the latest iPhones.. (iPhone 15 Pro or iPhone 16). The next release of Apple Intelligence iOS 18.4 will be in April. Additionally, DeepSeek breakthrough can help with AI adoption on phones. Tim Cook: “In October, we released the first set of Apple Intelligence features in U.S. (...) And we were excited to recently begin our international expansion with Apple Intelligence now available in Australia, Canada, New Zealand, South Africa, and the U.K. We're working hard to take Apple Intelligence even further. In April, we're bringing Apple Intelligence to more languages, including French, German, Italian, Portuguese, Spanish, Japanese, Korean, and simplified Chinese, as well as localized English to Singapore and India. (…) we did see that the markets where we had rolled out Apple Intelligence that the year over year performance on the iPhone 16 family was stronger than those where Apple Intelligence was not available. In terms of the features that people are using, they're using all of the ones that I'd referenced in my opening comments, from Writing Tools to Image Playground and Genmoji, to visual intelligence and more.” Figure 1 shows TTM revenues and 3 growth waves... can Apple Intelligence cause a 4th wave? For a complete picture, Figure 2 shows quarterly revenues.

Meta Q2 2023 review

28-Jul-2023. Meta Platforms: also delivered strong results for Q2 2023. Not only from the macro side we see that the economy is strong, but also from the side of the results of companies such as Meta or Alphabet (in general a strong advertising market drives revenue growth). In the case of Meta, the market expected YoY revenue growth in Q2 2023 of +7.8%, and received +11.0%. In addition, in Q3 revenue growth will amount to +20.0% (the middle of the company's forecast range), while the market expected only +12.6%. Susan Li, CFO on Q2 revenue acceleration: “Within ad revenue (JJ: ad rev constitutes just 98,4% of total rev), the online commerce vertical was the largest contributor to year-over-year growth, followed by entertainment & media and CPG (…). On a user geography basis, ad revenue growth was strongest in Rest of World at 16%, followed by Europe, North America and Asia-Pacific at 14%, 11% and 10%, respectively (…). In terms of the Q2 revenue acceleration, I'd highlight there are a few factors driving that. The first is, frankly, we're lapping a weaker demand period, including the first full quarter of the war in Ukraine and the suspension of our services in Russia. Second, we saw increased supply and improvements to ad performance, including improved Reels monetization as we continue to work down the Reels revenue headwind. And third, there were lower FX headwinds for us this quarter. So those were all three things that helped drive the revenue acceleration in Q2 (…).” And Susan’s comments on Q3 and Q4 revenue acceleration: “Turning now to the revenue outlook. We expect third quarter 2023 total revenue to be in the range of $32-34.5 billion. Our guidance assumes a foreign currency tailwind of approximately 3% to year-over-year total revenue growth in the third quarter, based on current exchange rates (…). So on the further acceleration that we've guided to in Q3, first of all, I'd just point out that Q3'22 revenue declined 4.5% year-over-year so we're really lapping a much weaker demand period a year ago, and we've certainly seen demand this year stabilize and so it's really a much easier compare. We also are expecting that currency is going to flip to a 3-point tailwind from a 1-point headwind last quarter (…). In terms of what this means for Q4, we're not sharing a Q4 revenue outlook yet. There are obviously some tailwinds to year-over-year growth in Q4. Again, the same point about a weaker compare applies. And at current rates, FX would be a larger tailwind in Q4 than we're expecting it to be in Q3. But we've had sizable fluctuations in advertiser demand over the last year. It's been a pretty volatile period. So while we're seeing strong advertiser demand now and that's certainly informing our outlook, it's harder to predict as we look further forward (…).”

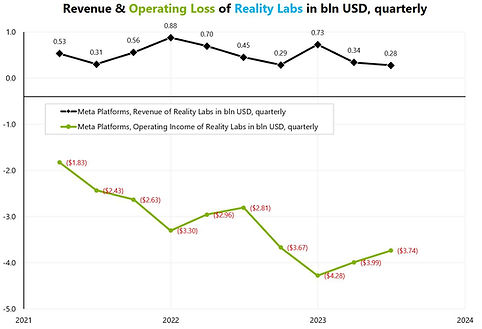

29-Jul-2023. Meta Platforms, a little more about financial results and a new business line generating huge losses. The Reality Labs business segment generates approximately $4 billion in operating loss per quarter. This is a lot, because it’s about 1/3 of the operating profit from the profitable part of the company's business (Family of Apps). Operating loss in 2022 within Reality Labs amounted to USD 13.7 billion, in 2023 it will be higher, and in 2024 according to Susan Li, CFO: "for Rality Labs, we expect operating losses to increase meaningfully year-over-year due to our ongoing product development efforts in AR/VR (JJ: Augmented Reality / Virtual Reality) and our investments to further scale our ecosystem.” So next year, the cumulative losses from Reality Labs will approach $50 billion. What does the money at Reality Labs mainly go to? The Meta doesn't provide details, but it's generally about the Quest 3 headset, VR, AR, investment in metaverse social platforms and neural interfaces. Such losses worry investors ... Goldman Sachs analyst during the earnings conference: „(…) The RL losses just continue to build. And I think we continue to struggle a little bit of what drivers of those losses are and how should we think about some of the components driving the losses versus elements of earning a return on those losses over the medium to long term”. Bank of America Merrill Lynch analyst: “I guess I want to follow up on Reality Labs, passing $40 billion in losses and increasing annually next year. Just think about -- maybe help us understand how the ROI on the business, how you're thinking about that investment, either on a stand-alone basis or as a complement to the Family of Apps, if you're thinking about it from an investor perspective.“ In response, Mark Zuckerberg: “(…) I know from an investor standpoint, most people aren't investing on quite as long of a time horizon as we are here, so I kind of get that, a lot of investors might want to see us spending less here in the near term. My view is that we are leading in these areas. I believe that they're going to be big over time. I think we've shown that we can deliver good business results in the near term while investing ambitiously in the long term. So I'm planning on continuing to do that, and I do continue to believe that over time, we will be happy that we did that.” “(…) This is a very long-term bet. At a deep level, I understand the discomfort that a lot of investors have with it because it's just outside of the model of, I think, even most long-term investors, how you would think about this. And look, I mean, I can't guarantee you that I'm going to be right about this bet. I do think that this is the direction that the world is going in. There are 1 billion or 2 billion people who have glasses today. I think in the future, they're all going to be smart glasses.”

Meta Q3 2023 review

26-Oct-2023. Meta. Q3 2023 earnings review. Immediately after the publication of the results, the Meta price increased by appr. 4% (in after-hours trading), but a few hours later it dropped to some -3% from the close of cash market. Q3 results beat expectations: 1) Total revenues amounted to $34.15 billion (+1.8% sales surprise), which means +23.2% YoY (expected +20.9%), Chart 1, 2) Advertising revenues amounted to $33.64 billion (+2.1% sales surprise), which means +23.5% YoY (expected +20.9%), Chart 2, 3) Diluted EPS $4.39 (+20.9% EPS surprise), which means +168% YoY (expected +121%). The remaining revenue segments are immaterial. Meta also reports Other Revenue (only 0.86% of total revenues), and Reality Labs revenues (only 0.62% of total revenues). Meta also reports the Family of Apps segment, which is the sum of Advertising and Other Revenue. Important points from CFO's outlook commentary: 1) Expected total revenues in Q4 2023 are $36.5-40 billion (this would mean YoY +13.5-24.4%), 2) Repeated statement from Q2 that Reality Labs' operating loss will increase YoY in 2023, 3) Repeated statement from Q2 that Reality Labs' operating loss will increase significantly in 2024: "we expect operating losses to increase meaningfully year-over-year due to our ongoing product development efforts in augmented reality/virtual reality and our investments to further scale our ecosystem", 4) They reduced the CAPEX forecast for 2023 by approximately 3% vs. the previous forecast from Q2 (to the level of $27-29 billion), 5) They provided a CAPEX forecast for 2024: $30-35 billion (the CAPEX increase is: " (...) driven by investments in servers, including both non-artificial intelligence (AI) and AI hardware, and data centers as we ramp up construction on sites with the new data center architecture we announced late last year.” Reality Laps brings huge losses. The cumulative operating loss since Q1 2021 is $35.4 billion and will exceed $50 billion next year. Fortunately, the growth of the business (the profitable part) reduces the share of the loss in the operating profit of the profitable part of the business - see chart 3.

Meta Q1 2024 review

25-Apr-2024. Meta Q1 2024 Earnings Review Meta has beaten analysts' expectations and the stock is down 15%. Go figure! Meta reported Q1 2024 Revenue of $36.46 billion (vs. expected $36.15 billion) with a +0.8% beat - see Figure 1. However, Q2 2024 revenue guidance missed Wall Street expectations by only 1.3% and this is apparently the main reason for the price drop - see Figure 2. Importantly, Meta provides a revenue range as guidance for the next quarter. An additional reason cited in the media is higher CAPEX. Wall Street expected CAPEX in 2024 at $34.89 billion. CFO Outlook Commentary: “We anticipate our full-year 2024 capital expenditures will be in the range of $35-40 billion, increased from our prior range of $30-37 billion as we continue to accelerate our infrastructure investments to support our artificial intelligence (AI) roadmap. While we are not providing guidance for years beyond 2024, we expect capital expenditures will continue to increase next year as we invest aggressively to support our ambitious AI research and product development efforts.” All in all, my gut feeling is that we are just in the middle of a mean-reverting stock market correction – so Meta has just joined the harder falling stocks because it had previously grown significantly. Missed guidance or higher CAPEX was just a trigger and/or an excuse.

Meta Q3 2024 Review

3-Nov-2024. Meta Q3 Earnings Review. Meta reported quite solid results, however all that has been already priced in as the stock price have increased by 24.6% since the previous earnings release (S&P500 +5.3% over the same period). My key takeaways: 1) Meta beat revenue growth expectations in Q3 2024 on almost all lines (except Reality Labs, which is not significant because it only accounts for 0.7% of total revenue). Total Revenue grew by 18.9% YoY in Q3 – see Figure 1. 2) Meta has no intention of slowing down in Q4 2024 – it has given a revenue growth guidance for Q4 above Wall Street expectations. In Q4, Meta expects revenue in the range of $45-48 billion, and looking at the history of beating its own forecasts (Figure 2), the upper range of the forecast ($48 billion) means YoY growth of as much as 19.7%! This is impressive for a company of this size... 3) Meta intends to continue to invest aggressively, Susan Li, CFO: “We anticipate our full year 2024 capital expenditures will be in the range of $38-40 billion, updated from our prior range of $37-40 billion. We continue to expect significant capital expenditures growth in 2025. Given this, along with the back-end weighted nature of our 2024 capex, we expect a significant acceleration in infrastructure expense growth next year as we recognize higher growth in depreciation and operating expenses of our expanded infrastructure fleet”. Mark Zuckerberg on Meta’s AI models: “The Llama 3 models have been something of an inflection point in the industry, but I'm even more excited about Llama 4, which is now well into its development. We're training the Llama 4 models on a cluster that is bigger than 100k H100s or bigger than anything that I've seen reported for what others are doing. I expect that the smaller Llama 4 models will be ready first, and they’ll be ready, we expect sometime early next year, and I think that they're going to be a big deal on several fronts -- new modalities, capabilities, stronger reasoning, and much faster”. All in all: solid results, solid growth outlook, increased CAPEX and wide AI adoption and ongoing intense AI-related investments. Figure 3 shows Advertising segment revenues. Figure 4 shows Other Revenue segment revenues. Figure 5 shows Family of Apps segment revenues (Advertising + Other Revenue). Total Revenue: Family of Apps + Reality Labs (Figure 1). Figure 6 shows Reality Labs segment revenues. Figure 7 shows Reality Labs segment revenues and operating loss. Figure 8 shows how much of the operating profit (of the Family of Apps segment) is the operating loss of the Reality Labs.

Meta Q4 2024 Review

2-Feb-2025. Meta’s strong earnings! Meta showed strong Q4 2024 results – with Q4 revenue of $48.4B beating the Street by 3.2% - see Figure 1. It was also above Meta’s previous quarter guidance ($45-48B) – see Figure 2. Nevertheless, the company’s Q1 guidance was below market expectations (mid-range of only $40.65B vs. Street expectations of $41.7B). Meta is an example of rapid adoption of AI tools (Meta AI)… currently there are around 500m MAU (monthly active users) of Meta AI, but there is also a strong growth from the advertisers side: Susan Li, CFO: “Advantage+ creative is another area where we’re seeing momentum. More than 4 million advertisers are now using at least one of our generative AI ad creative tools, up from one million six months ago.” But within the company's business model, AI solutions will be monetized only once a large scale is built. China's DeepSeek doesn't seem to be a problem for the company either, quite the opposite: Mark Zuckerberg: “I can start on the DeepSeek question. I think there’s a number of novel things that they did that I think we’re still digesting. And there are a number of things that they have advances that we will hope to implement in our systems. And that’s part of the nature of how this works, whether it’s a Chinese competitor or not. (…) And that’s sort of how the technology industry goes. I don’t know -- it’s probably too early to really have a strong opinion on what this means for the trajectory around infrastructure and CapEx and things like that. There are a bunch of trends that are happening here all at once. There’s already sort of a debate around how much of the compute infrastructure that we’re using is going to go towards pretraining versus as you get more of these reasoning time models or reasoning models where you get more of the intelligence by putting more of the compute into inference, whether just it will mix shift how we use our compute infrastructure towards that.” After the DeepSeek events … Meta does not intend to reduce capital expenditures. CAPEX in 2025 will remain at the previously (before the DeepSeek revelations) announced level of $60-65B – a significant increase from 2024 – see Figure 3 and 4. More from Mark Zuckerberg on CAPEX and DeepSeek: “The field continues to move quickly. There’s a lot to learn from releases from basically everyone who does something interesting, not just the ones over the last month. We’ll continue to kind of incorporate that into what we do as well as making novel contributions to the field ourselves. And I continue to think that investing very heavily in CapEx and infra is going to be a strategic advantage over time. It’s possible that we’ll learn otherwise at some point, but I just think it’s way too early to call that. And at this point, I would bet that the ability to build out that kind of infrastructure is going to be a major advantage for both the quality of the service and being able to serve the scale that we want to”.

Meta: Winning in style!