Apple December 2023 quarter earnings review. Part 1.

- Jarosław Jamka

- 5 lut 2024

- 2 minut(y) czytania

Will the latest technological marvel, Vision Pro glasses, save Apple this year?

Apple Vision Pro is available in U.S. stores starting Friday, February 2. There is no doubt about customer delight, but sales volume will be important for investors. This product has the potential to drive the company's revenue growth in 2024.

Yet, the lack of significant growth or even the risk of a decline in revenues is the company's main challenge and the main risk for investors that at some point the share price may react negatively.

My key takeaways form recent earnings release:

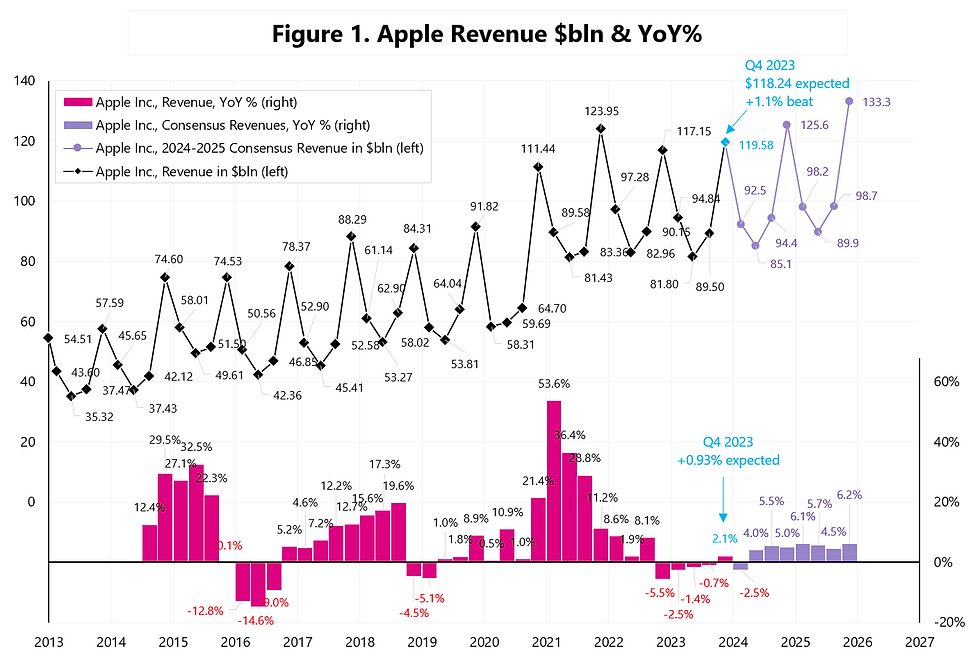

1) Apple's total sales in Q4 2023 grew only 2.1% year-over-year. But in Q4 2022, due to disruptions in supply chains, iPhone sales were approximately $5 billion lower, and this demand was only met in Q1 2023. In other words, $5 billion in sales moved from Q4 2022 to Q1 2023. If we take this effect into account in the comparison of Q4 2022 and Q4 2023, instead of a 2.1% increase we would get a 2.1% decrease in sales. Since nothing in nature is lost, we will formally see this effect in the decline in sales in the first quarter of 2024. And now the analysts' consensus forecast of Apple's revenues in the calendar Q1 2024 is USD 92.5 billion, which means a year-on-year decline of 2.5% - see Figure 1.

Figure 2 shows the dollar contributions to the annual change in revenues – by business segments. iPhone added USD 3.9 billion, but if we added USD 5 billion in sales to Q4 2022 - the contribution would be negative.

2) Apple is making up for the lack of sales growth with higher gross profit margin, which has increased from levels of around 38% in 2020 to the current 45.9%. Apple forecasts its further growth in calendar Q1 2024 to the range of 46-47% - see Figure 3.

3) Weak sales in China are a concern (Figure 4). Well-known Apple analyst from TF International Securities, Ming-Chi Kuo recently stated that the new paradigm in phone design includes the use of artificial intelligence and foldable phones, and the main reason for the decline in Apple sales on the Chinese market is the growing interest in foldable phones (which Huawei benefits from). According to Ming-Chi Kuo, shipments of iPhone 15 series and new iPhone 16 series will decline by 10-15% y/y in the first and second half of 2024, respectively.

Komentarze